Deep-pocketed investors have adopted a bearish approach towards Zscaler (NASDAQ:ZS), and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ZS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 30 extraordinary options activities for Zscaler. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 63% bearish. Among these notable options, 6 are puts, totaling $231,968, and 24 are calls, amounting to $2,815,412.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $370.0 for Zscaler over the last 3 months.

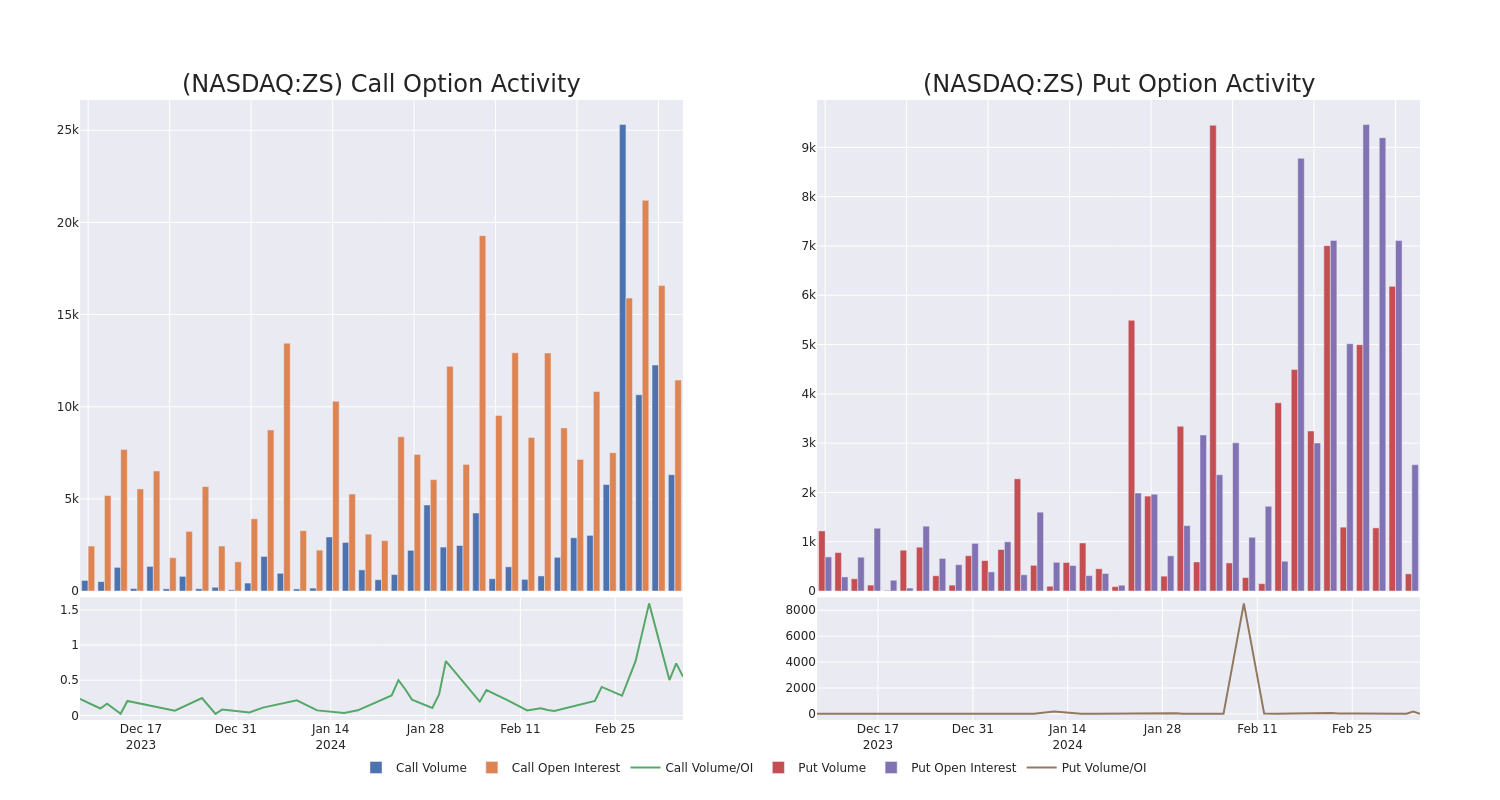

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Zscaler’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Zscaler’s significant trades, within a strike price range of $110.0 to $370.0, over the past month.

Zscaler Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| ZS | CALL | TRADE | BEARISH | 06/21/24 | $230.00 | $605.0K | 829 | 506 |

| ZS | CALL | SWEEP | BULLISH | 01/16/26 | $370.00 | $524.5K | 1.8K | 580 |

| ZS | CALL | TRADE | BEARISH | 06/21/24 | $230.00 | $302.5K | 829 | 256 |

| ZS | CALL | TRADE | BEARISH | 01/16/26 | $370.00 | $185.0K | 1.8K | 100 |

| ZS | CALL | TRADE | BULLISH | 01/16/26 | $370.00 | $184.1K | 1.8K | 300 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler’s offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Having examined the options trading patterns of Zscaler, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Zscaler

- With a volume of 1,954,152, the price of ZS is up 3.7% at $214.0.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 85 days.

Professional Analyst Ratings for Zscaler

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $256.8.

- An analyst from Rosenblatt has decided to maintain their Buy rating on Zscaler, which currently sits at a price target of $290.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Zscaler, targeting a price of $265.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Zscaler with a target price of $255.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Zscaler, which currently sits at a price target of $214.

- An analyst from Truist Securities has decided to maintain their Buy rating on Zscaler, which currently sits at a price target of $260.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Zscaler with Benzinga Pro for real-time alerts.