High-rolling investors have positioned themselves bullish on Walt Disney (NYSE:DIS), and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DIS often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 32 options trades for Walt Disney. This is not a typical pattern.

The sentiment among these major traders is split, with 62% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $42,075, and 31 calls, totaling $4,808,157.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $125.0 for Walt Disney over the recent three months.

Insights into Volume & Open Interest

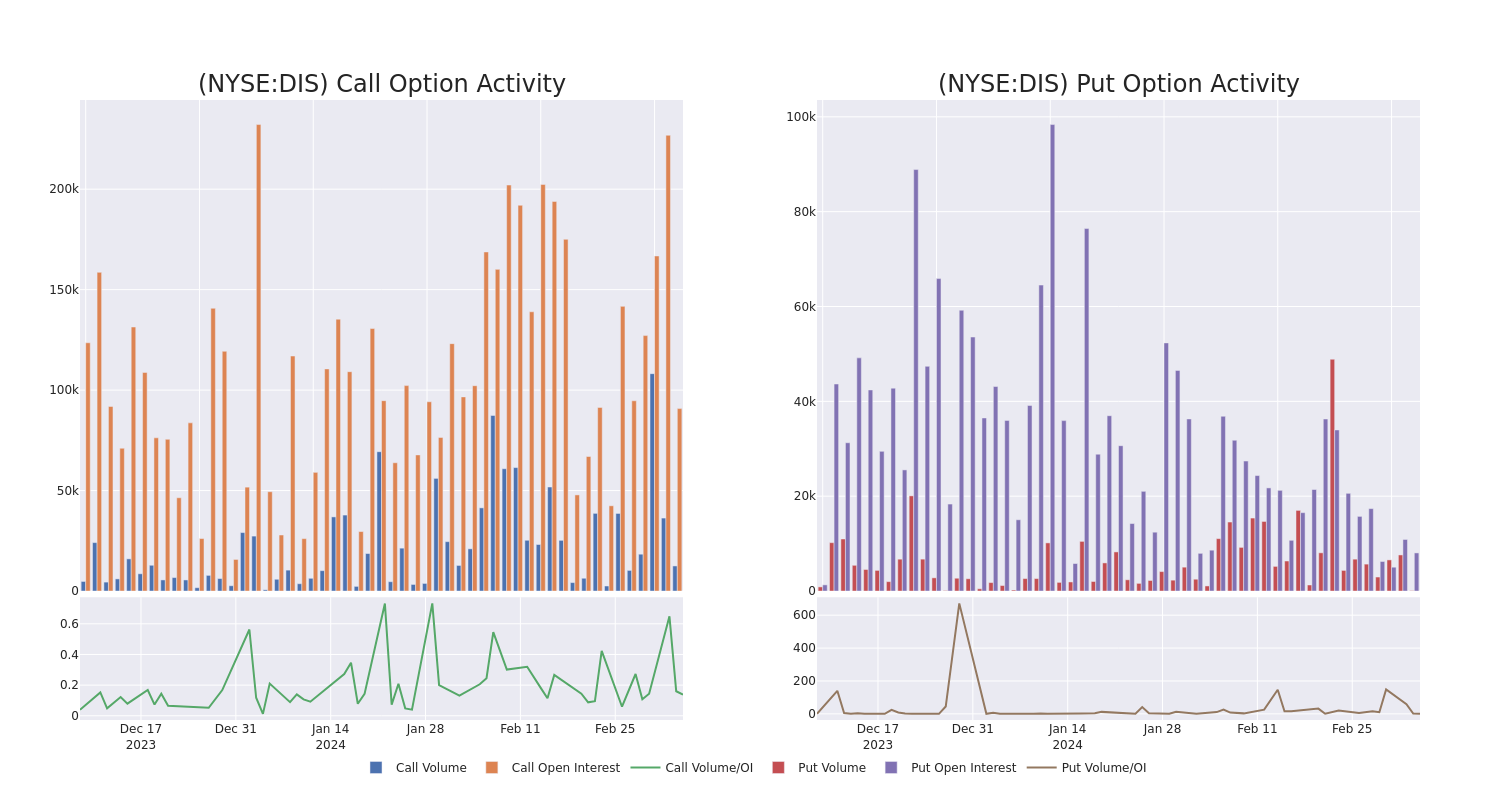

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walt Disney’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walt Disney’s substantial trades, within a strike price spectrum from $75.0 to $125.0 over the preceding 30 days.

Walt Disney Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $110.00 | $640.9K | 6 | 489 |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $110.00 | $601.6K | 6 | 1.4K |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $110.00 | $580.1K | 6 | 489 |

| DIS | CALL | SWEEP | NEUTRAL | 03/21/25 | $110.00 | $499.9K | 6 | 1.8K |

| DIS | CALL | TRADE | BULLISH | 03/21/25 | $110.00 | $441.4K | 6 | 881 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney’s own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney’s theme parks and vacation destinations, and also benefits from merchandise licensing.

Where Is Walt Disney Standing Right Now?

- Currently trading with a volume of 4,065,959, the DIS’s price is up by 0.21%, now at $113.11.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 63 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walt Disney, Benzinga Pro gives you real-time options trades alerts.