Financial giants have made a conspicuous bullish move on Carvana. Our analysis of options history for Carvana (NYSE:CVNA) revealed 31 unusual trades.

Delving into the details, we found 74% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $802,755, and 18 were calls, valued at $1,341,760.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $125.0 for Carvana over the recent three months.

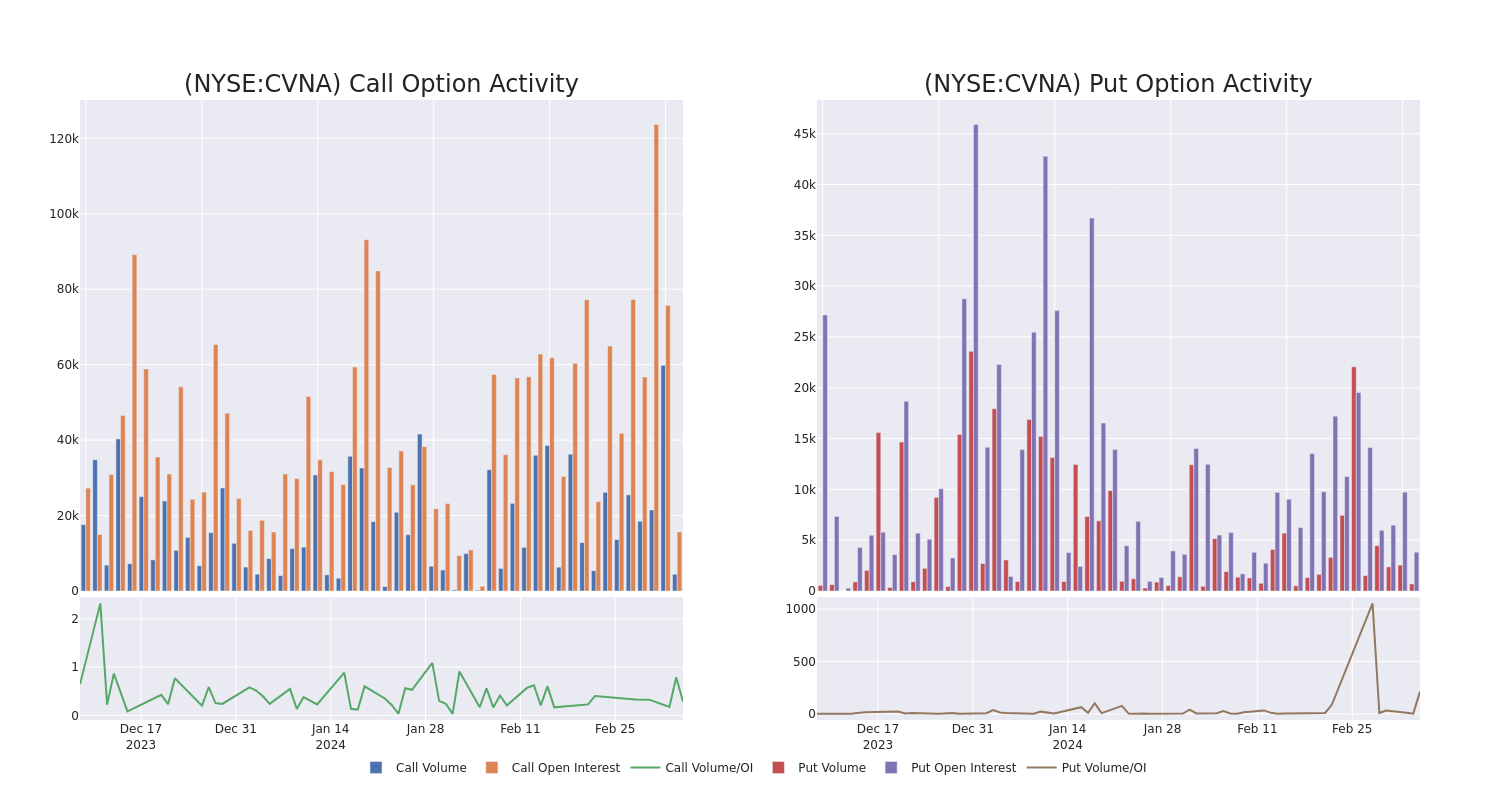

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Carvana’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carvana’s whale activity within a strike price range from $25.0 to $125.0 in the last 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | SWEEP | BEARISH | 03/15/24 | $25.00 | $495.0K | 293 | 13 |

| CVNA | CALL | TRADE | BEARISH | 03/28/24 | $60.00 | $107.5K | 115 | 50 |

| CVNA | CALL | SWEEP | BULLISH | 01/16/26 | $45.00 | $87.1K | 121 | 0 |

| CVNA | CALL | TRADE | BULLISH | 01/16/26 | $60.00 | $83.0K | 118 | 20 |

| CVNA | CALL | SWEEP | BEARISH | 03/15/24 | $25.00 | $71.5K | 293 | 13 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

After a thorough review of the options trading surrounding Carvana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Carvana’s Current Market Status

- With a trading volume of 1,985,006, the price of CVNA is up by 2.03%, reaching $78.9.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 57 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.