Financial giants have made a conspicuous bullish move on Accenture. Our analysis of options history for Accenture (NYSE:ACN) revealed 10 unusual trades.

Delving into the details, we found 70% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $255,800, and 5 were calls, valued at $512,804.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $340.0 to $380.0 for Accenture over the recent three months.

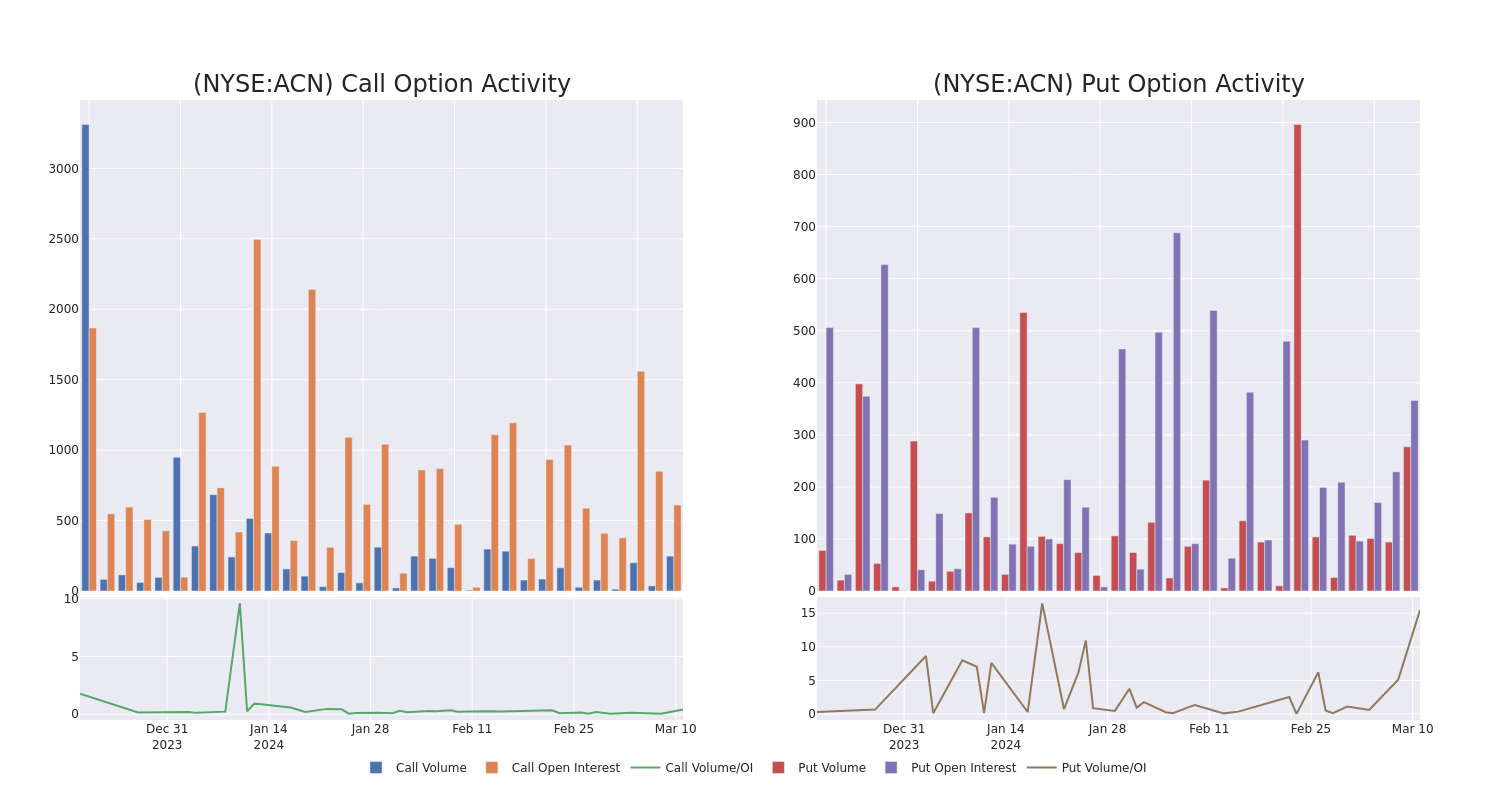

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Accenture options trades today is 139.43 with a total volume of 525.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Accenture’s big money trades within a strike price range of $340.0 to $380.0 over the last 30 days.

Accenture Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| ACN | CALL | SWEEP | BULLISH | 06/21/24 | $340.00 | $252.4K | 380 | 79 |

| ACN | CALL | SWEEP | BULLISH | 09/20/24 | $370.00 | $98.1K | 55 | 33 |

| ACN | CALL | TRADE | BULLISH | 09/20/24 | $370.00 | $74.2K | 55 | 78 |

| ACN | PUT | SWEEP | BEARISH | 06/21/24 | $380.00 | $66.9K | 240 | 38 |

| ACN | PUT | SWEEP | BULLISH | 09/20/24 | $370.00 | $64.9K | 104 | 40 |

About Accenture

Accenture is a leading global IT-services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

After a thorough review of the options trading surrounding Accenture, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Accenture Standing Right Now?

- Currently trading with a volume of 640,295, the ACN’s price is down by -1.01%, now at $374.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 10 days.

What The Experts Say On Accenture

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $383.0.

- An analyst from RBC Capital downgraded its action to Outperform with a price target of $374.

- An analyst from B of A Securities has decided to maintain their Buy rating on Accenture, which currently sits at a price target of $419.

- Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Accenture with a target price of $364.

- An analyst from Baird has decided to maintain their Neutral rating on Accenture, which currently sits at a price target of $375.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Accenture with Benzinga Pro for real-time alerts.