Whales with a lot of money to spend have taken a noticeably bullish stance on Pfizer.

Looking at options history for Pfizer (NYSE:PFE) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 47% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $233,220 and 15, calls, for a total amount of $928,582.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $18.0 and $44.0 for Pfizer, spanning the last three months.

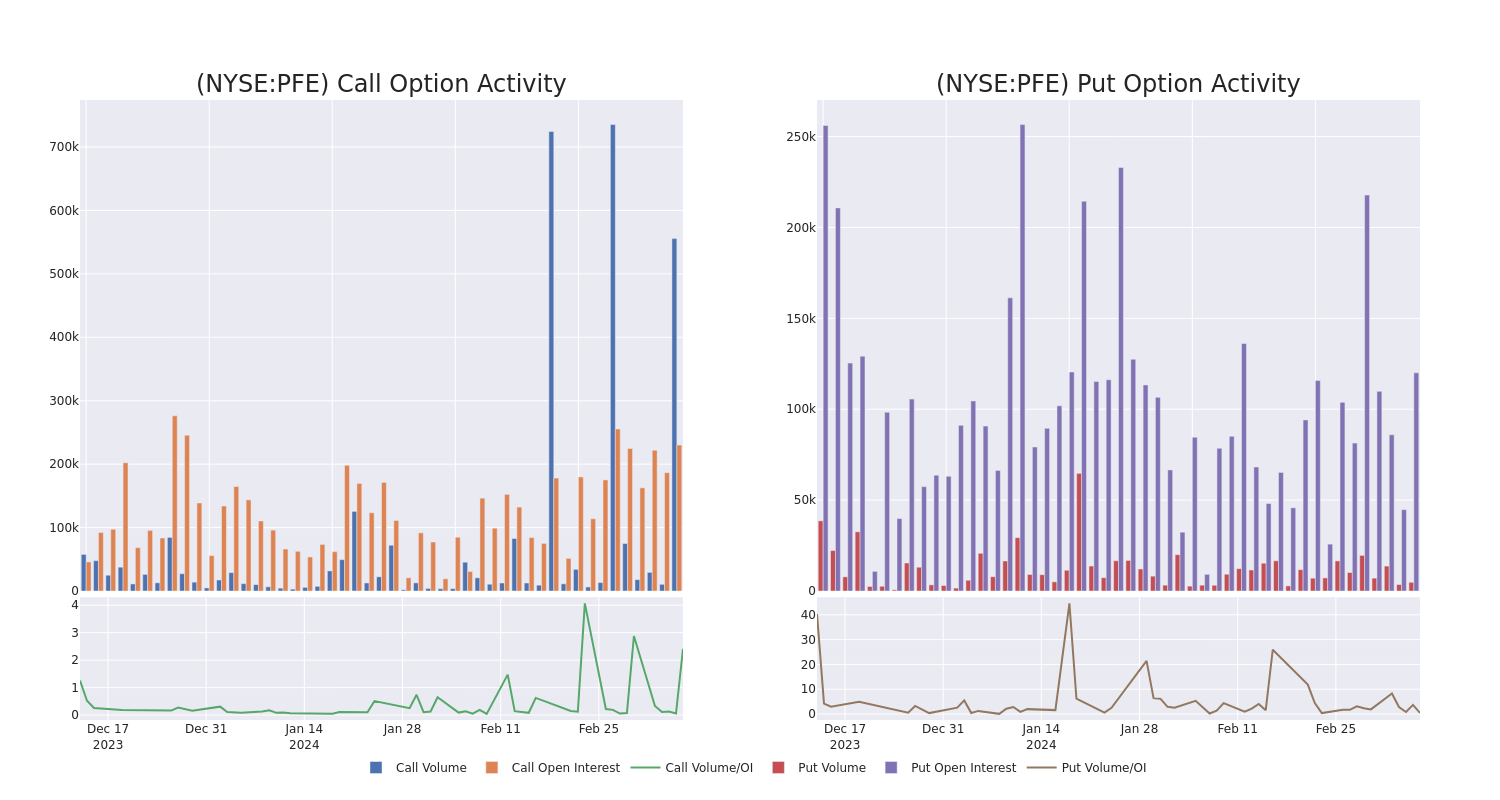

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Pfizer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Pfizer’s significant trades, within a strike price range of $18.0 to $44.0, over the past month.

Pfizer Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PFE | CALL | SWEEP | BEARISH | 09/20/24 | $25.00 | $375.0K | 4.2K | 103 |

| PFE | PUT | SWEEP | BULLISH | 05/17/24 | $44.00 | $131.2K | 0 | 120 |

| PFE | PUT | TRADE | BEARISH | 10/18/24 | $32.00 | $101.9K | 0 | 200 |

| PFE | CALL | SWEEP | BULLISH | 06/20/25 | $28.00 | $64.8K | 3.8K | 200 |

| PFE | CALL | TRADE | BULLISH | 12/19/25 | $30.00 | $63.0K | 3.5K | 200 |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Having examined the options trading patterns of Pfizer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Pfizer’s Current Market Status

- With a volume of 13,316,600, the price of PFE is up 0.51% at $27.36.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 50 days.

What The Experts Say On Pfizer

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $42.0.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

- An analyst from Guggenheim downgraded its action to Buy with a price target of $36.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.