Deep-pocketed investors have adopted a bearish approach towards SoFi Techs (NASDAQ:SOFI), and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SOFI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 13 extraordinary options activities for SoFi Techs. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 69% bearish. Among these notable options, 3 are puts, totaling $106,680, and 10 are calls, amounting to $520,482.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $20.0 for SoFi Techs during the past quarter.

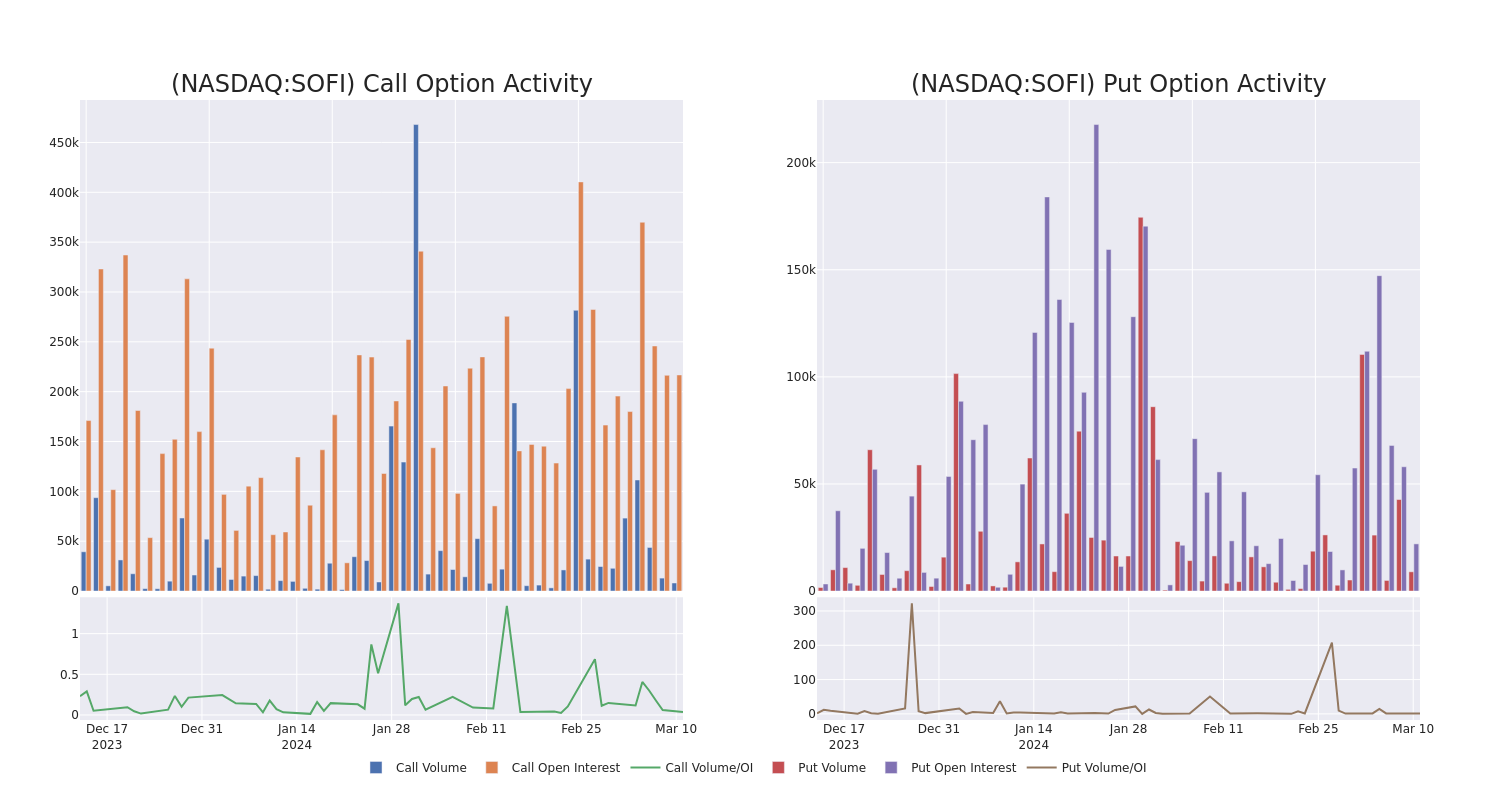

Volume & Open Interest Development

In today’s trading context, the average open interest for options of SoFi Techs stands at 21709.91, with a total volume reaching 17,074.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in SoFi Techs, situated within the strike price corridor from $5.0 to $20.0, throughout the last 30 days.

SoFi Techs 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SOFI | CALL | SWEEP | BEARISH | 01/16/26 | $7.00 | $213.0K | 18.7K | 1.1K |

| SOFI | CALL | TRADE | BULLISH | 01/16/26 | $5.00 | $66.7K | 9.8K | 165 |

| SOFI | PUT | TRADE | BEARISH | 05/17/24 | $8.00 | $50.1K | 8.1K | 611 |

| SOFI | CALL | SWEEP | BEARISH | 01/16/26 | $7.00 | $40.8K | 18.7K | 1.3K |

| SOFI | CALL | TRADE | BULLISH | 01/16/26 | $10.00 | $37.0K | 45.4K | 493 |

About SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients’ finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

Having examined the options trading patterns of SoFi Techs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of SoFi Techs

- With a volume of 19,535,320, the price of SOFI is up 1.3% at $7.81.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 49 days.

Professional Analyst Ratings for SoFi Techs

2 market experts have recently issued ratings for this stock, with a consensus target price of $5.5.

- An analyst from Wedbush downgraded its action to Underperform with a price target of $3.

- An analyst from Piper Sandler downgraded its action to Neutral with a price target of $8.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest SoFi Techs options trades with real-time alerts from Benzinga Pro.