Financial giants have made a conspicuous bearish move on Lam Research. Our analysis of options history for Lam Research (NASDAQ:LRCX) revealed 22 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $444,650, and 15 were calls, valued at $657,803.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $300.0 and $1360.0 for Lam Research, spanning the last three months.

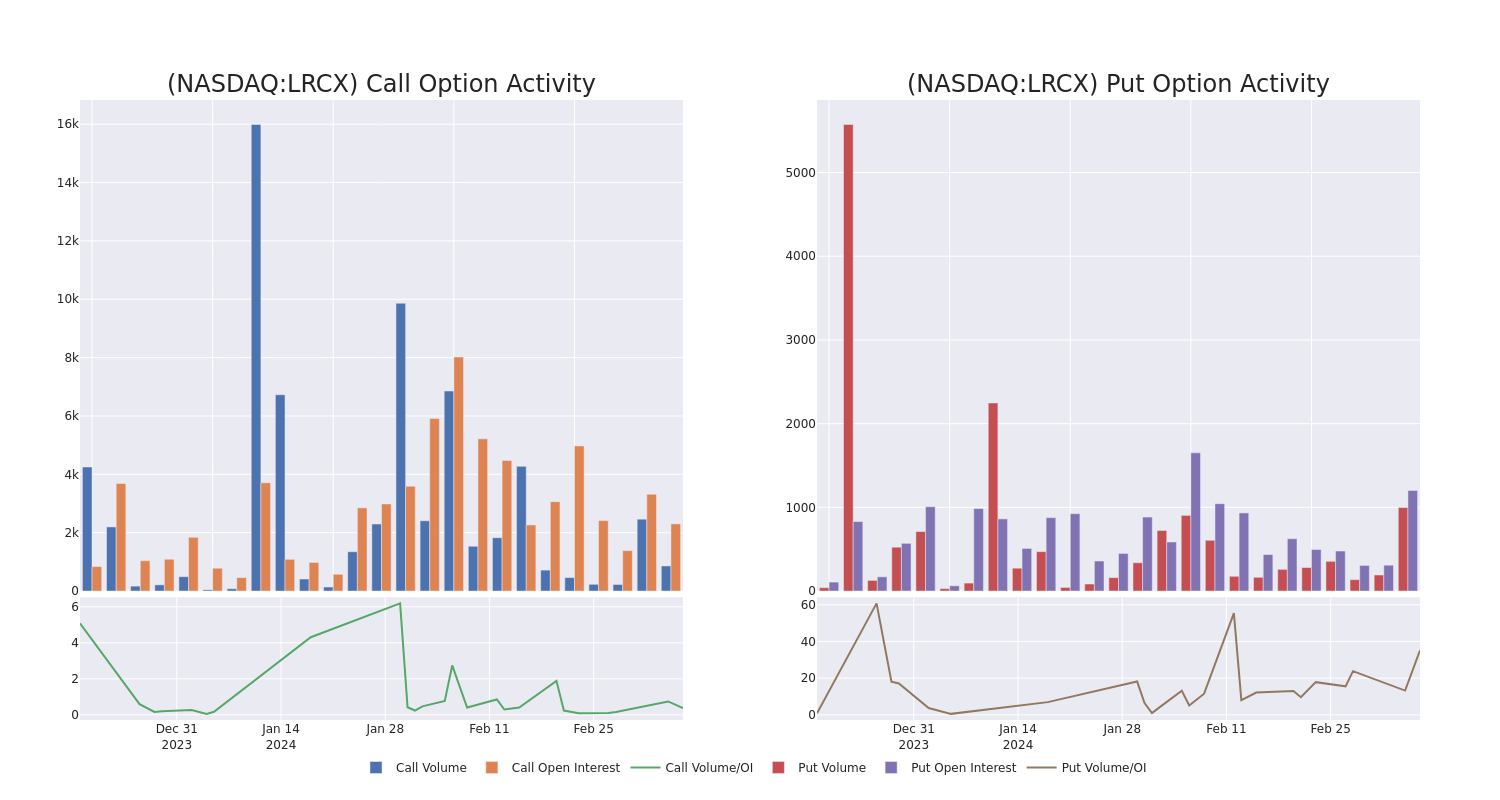

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Lam Research options trades today is 121.74 with a total volume of 220.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lam Research’s big money trades within a strike price range of $300.0 to $1360.0 over the last 30 days.

Lam Research Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | TRADE | BULLISH | 03/15/24 | $930.00 | $117.7K | 140 | 54 |

| LRCX | PUT | TRADE | BULLISH | 06/21/24 | $810.00 | $83.4K | 98 | 0 |

| LRCX | PUT | TRADE | BEARISH | 01/16/26 | $800.00 | $82.4K | 239 | 8 |

| LRCX | CALL | TRADE | BULLISH | 09/20/24 | $795.00 | $75.7K | 6 | 4 |

| LRCX | CALL | TRADE | BEARISH | 03/15/24 | $740.00 | $75.4K | 134 | 5 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

After a thorough review of the options trading surrounding Lam Research, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Lam Research

- Currently trading with a volume of 299,184, the LRCX’s price is down by -1.23%, now at $944.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 37 days.

Professional Analyst Ratings for Lam Research

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $957.5.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $900.

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $900.

- An analyst from UBS has decided to maintain their Buy rating on Lam Research, which currently sits at a price target of $1130.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $900.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lam Research, Benzinga Pro gives you real-time options trades alerts.