Benzinga’s options scanner just detected over 12 options trades for Riot Platforms (NASDAQ:RIOT) summing a total amount of $1,165,713.

At the same time, our algo caught 6 for a total amount of 904,014.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $27.0 for Riot Platforms during the past quarter.

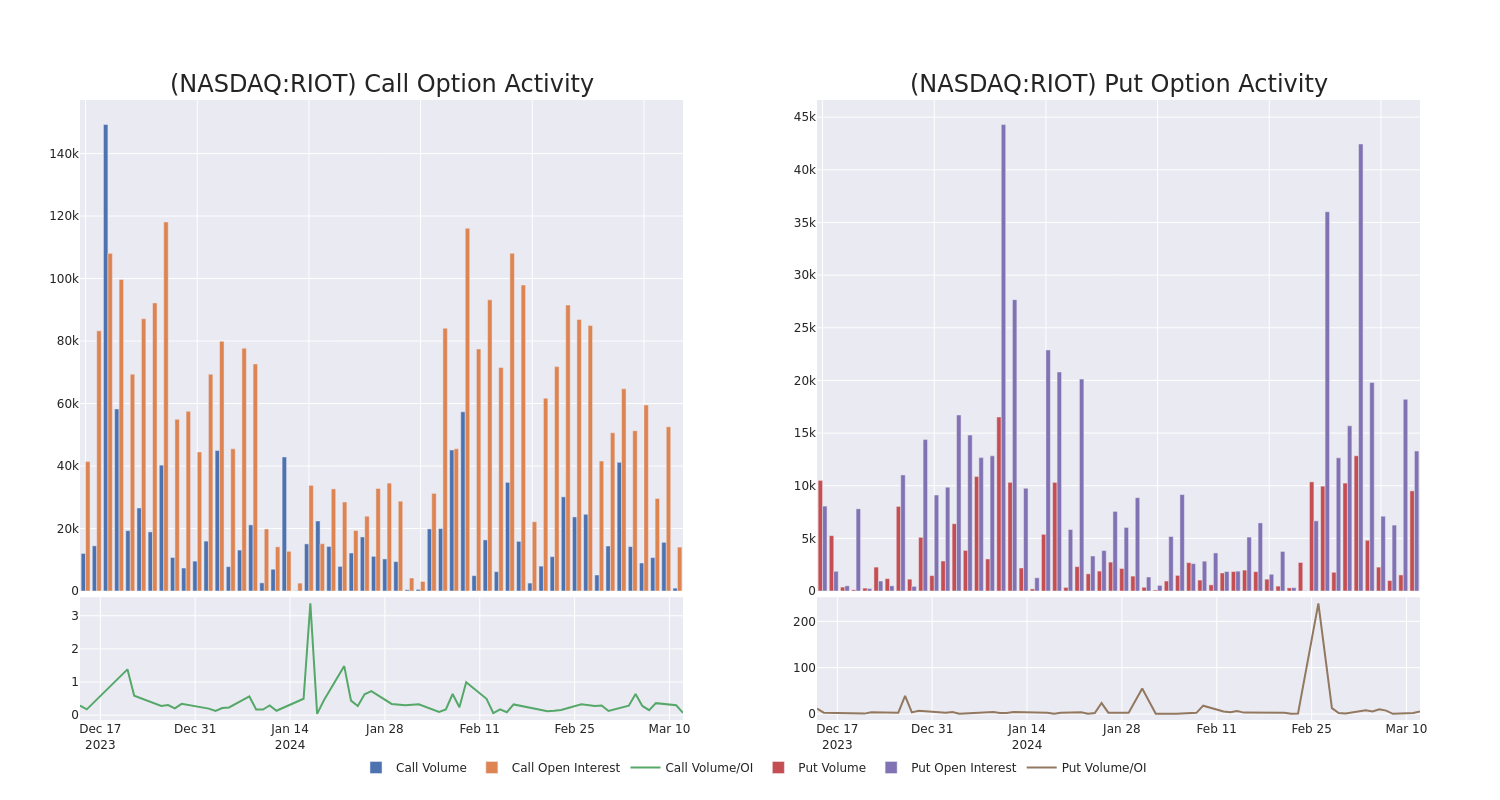

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Riot Platforms’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Riot Platforms’s substantial trades, within a strike price spectrum from $7.0 to $27.0 over the preceding 30 days.

Riot Platforms Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| RIOT | PUT | TRADE | BULLISH | 01/17/25 | $10.00 | $632.0K | 7.1K | 2.1K |

| RIOT | CALL | TRADE | BULLISH | 01/16/26 | $12.00 | $123.5K | 1.4K | 0 |

| RIOT | CALL | SWEEP | BEARISH | 01/17/25 | $12.00 | $107.8K | 5.5K | 260 |

| RIOT | PUT | SWEEP | BULLISH | 03/22/24 | $11.50 | $73.1K | 1.1K | 1.5K |

| RIOT | CALL | SWEEP | BULLISH | 06/21/24 | $12.00 | $63.4K | 3.3K | 289 |

About Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company’s segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

Having examined the options trading patterns of Riot Platforms, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Riot Platforms Standing Right Now?

- Currently trading with a volume of 9,780,647, the RIOT’s price is up by 0.42%, now at $11.83.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 57 days.

Professional Analyst Ratings for Riot Platforms

In the last month, 5 experts released ratings on this stock with an average target price of $19.4.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Riot Platforms with a target price of $18.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $19.

- Consistent in their evaluation, an analyst from HC Wainwright & Co. keeps a Buy rating on Riot Platforms with a target price of $20.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $20.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Riot Platforms with Benzinga Pro for real-time alerts.