Deep-pocketed investors have adopted a bearish approach towards Cava Group (NYSE:CAVA), and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAVA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for Cava Group. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 58% bearish. Among these notable options, 4 are puts, totaling $323,352, and 8 are calls, amounting to $636,826.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $45.0 to $75.0 for Cava Group over the last 3 months.

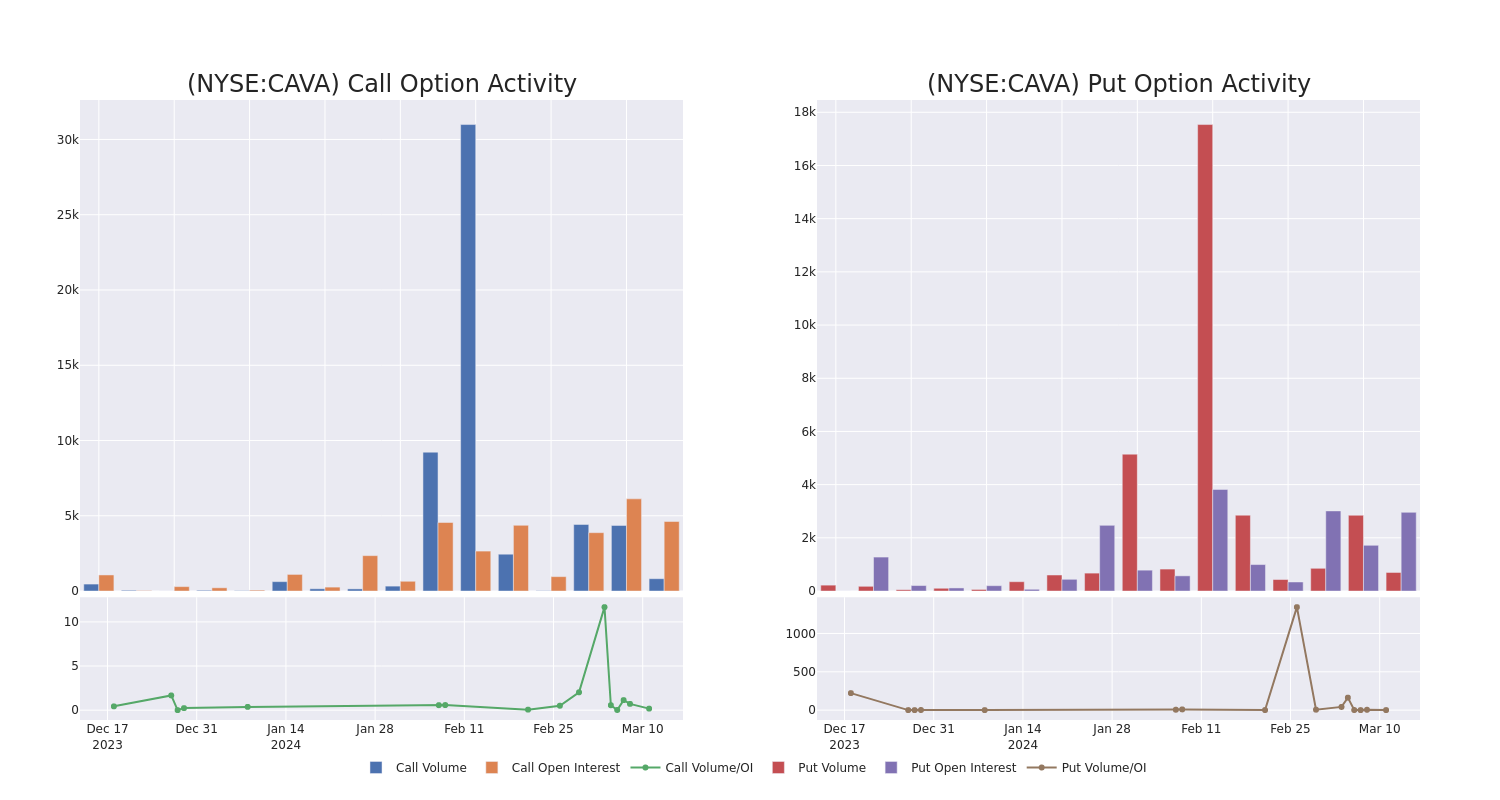

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cava Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cava Group’s substantial trades, within a strike price spectrum from $45.0 to $75.0 over the preceding 30 days.

Cava Group Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CAVA | CALL | SWEEP | BULLISH | 01/17/25 | $55.00 | $194.9K | 1.6K | 115 |

| CAVA | PUT | SWEEP | BEARISH | 01/17/25 | $55.00 | $179.3K | 2.7K | 695 |

| CAVA | PUT | TRADE | BULLISH | 01/17/25 | $65.00 | $152.9K | 1.7K | 210 |

| CAVA | CALL | SWEEP | BEARISH | 01/17/25 | $65.00 | $107.1K | 2.4K | 85 |

| CAVA | CALL | SWEEP | BEARISH | 01/17/25 | $70.00 | $103.2K | 143 | 489 |

About Cava Group

Cava Group Inc owns and operates a chain of restaurants. It is the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. The company’s dips, spreads, and dressings are centrally produced and sold in grocery stores. The company’s operations are conducted as two reportable segments: CAVA and Zoes Kitchen. The company generates the majority of its revenue from the CAVA segment.

Having examined the options trading patterns of Cava Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Cava Group

- Currently trading with a volume of 1,159,242, the CAVA’s price is up by 0.43%, now at $63.05.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 55 days.

What Analysts Are Saying About Cava Group

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $60.0.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on Cava Group, which currently sits at a price target of $63.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Cava Group, targeting a price of $62.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Cava Group, targeting a price of $65.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Cava Group, targeting a price of $60.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Cava Group, targeting a price of $50.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cava Group with Benzinga Pro for real-time alerts.