Whales with a lot of money to spend have taken a noticeably bullish stance on Palantir Technologies.

Looking at options history for Palantir Technologies (NYSE:PLTR) we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $547,946 and 10, calls, for a total amount of $549,603.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $17.0 and $35.0 for Palantir Technologies, spanning the last three months.

Analyzing Volume & Open Interest

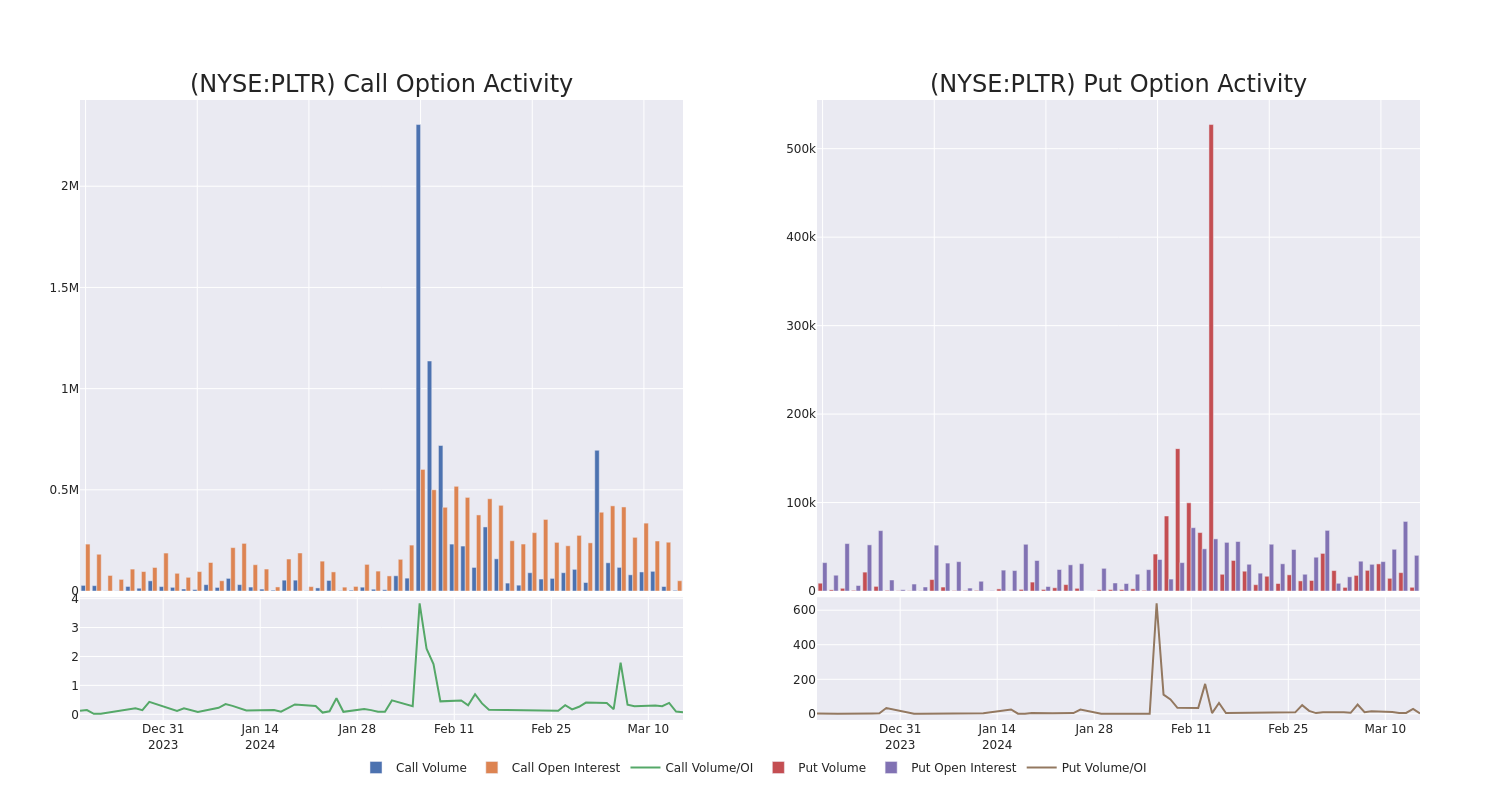

In terms of liquidity and interest, the mean open interest for Palantir Technologies options trades today is 6525.79 with a total volume of 7,737.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Palantir Technologies’s big money trades within a strike price range of $17.0 to $35.0 over the last 30 days.

Palantir Technologies Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PLTR | PUT | SWEEP | BULLISH | 07/19/24 | $22.00 | $237.5K | 1.0K | 998 |

| PLTR | PUT | SWEEP | BEARISH | 05/17/24 | $28.00 | $156.0K | 1.4K | 338 |

| PLTR | CALL | SWEEP | BULLISH | 09/20/24 | $27.00 | $114.4K | 4.7K | 340 |

| PLTR | CALL | TRADE | NEUTRAL | 06/21/24 | $35.00 | $105.0K | 9.8K | 1.5K |

| PLTR | CALL | SWEEP | BEARISH | 04/12/24 | $20.00 | $82.0K | 542 | 203 |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients’ organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir Technologies’s Current Market Status

- Trading volume stands at 13,095,875, with PLTR’s price down by -2.37%, positioned at $23.85.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 52 days.

What Analysts Are Saying About Palantir Technologies

In the last month, 3 experts released ratings on this stock with an average target price of $28.0.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Palantir Technologies, targeting a price of $35.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Palantir Technologies with a target price of $21.

- An analyst from B of A Securities persists with their Buy rating on Palantir Technologies, maintaining a target price of $28.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palantir Technologies with Benzinga Pro for real-time alerts.