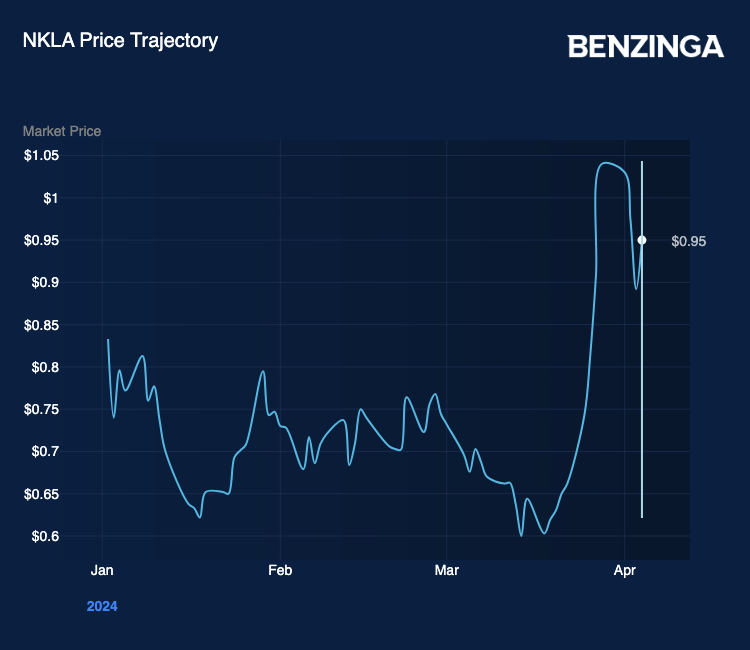

This Penny Stock EV Leaves Big Boys Tesla, Rivian And Lucid In The Dust With 14% YTD Gain

EV truck maker Nikola Corp (NASDAQ:NKLA) delivered 40 hydrogen fuel cell electric trucks in the first quarter, leading its shares to rally over 6% on Thursday. Given the low share price, even small increases translate into large percentage gains. But notably, Nikola’s stock is up 14.46% year-to-date, unlike most pure-play EV makers whose stocks have been falling.

Not An Easy Climb Back Up: However, Nikola’s path hasn’t been smooth. The company’s share value dropped from over $2 to below $1 in 2023 due to several setbacks, including multiple fire incidents with its battery-electric trucks, a subsequent recall, and executive reshuffles.

Nikola started delivering battery electric trucks before its hydrogen fuel cell trucks. However, the company recalled these vehicles in August following multiple fire incidents.

New BEV truck sales are currently halted as Nikola focuses on returning the recalled vehicles to customers.

Management Shuffles: The company also witnessed leadership changes, with Steve Girsky replacing Michael Lohscheller as CEO in August and Anastasiya Pasterick resigning as CFO after just a few months. Last month, former General Motors executive Thomas Okray was appointed as the new CFO.

For the whole of last year, Nikola produced a total of 38 trucks, less than the 258 it made in 2022. It reported a total revenue of $35.8 million and a gross loss of $214.1 million, higher than the $86 million loss reported in 2022.

However, the stock has been on an upward trend since the start of 2024, likely due to the sales of its hydrogen trucks and the anticipated return of its recalled BEVs. In February, Girsky stated that deliveries of fixed BEV trucks would restart in late Q3 or early Q4 of 2024. All recalled vehicles are projected to be back with customers by the end of Q2 or early Q3.

Traditional Automakers vs. EV Startups

Unlike established automakers like General Motors and Ford who produce both EVs and gas-powered vehicles, Nikola joins U.S. companies like Tesla Inc (NASDAQ:TSLA), Rivian Automotive Inc. (NASDAQ:RIVN), and Lucid Group Inc. (NASDAQ:LCID) in focusing solely on EVs.

Tesla shares are down 31.1% year-to-date, while Rivian and Lucid have slumped 52% and 36.1% respectively, reflecting concerns about a potential slowdown in electric vehicle demand.

Tesla reported an 8.5% year-over-year decline in Q1 sales, delivering 386,810 vehicles. While Rivian has managed to scale Q1 deliveries year-on-year, the company’s production target for the whole year remains around 57,000 units, similar to 2023. Both Rivian and Lucid continue to struggle with scaling production profitably and are losing money on each vehicle delivered.

In contrast, General Motors and Ford’s stock prices have risen 21.2% and 8.6% respectively.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.