Taiwan Semi Clocks Double-Digit Q1 Revenue Growth, Eyes Robust 2024 Amid AI Boom

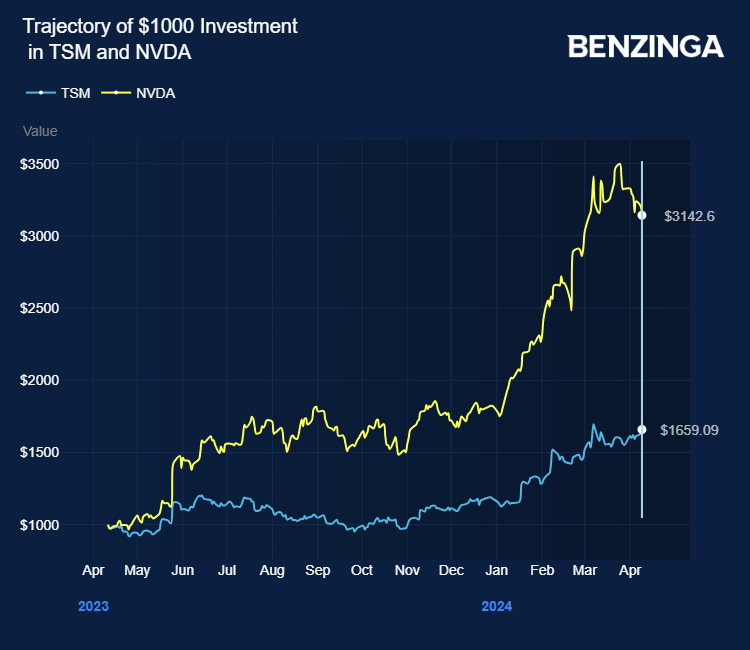

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) reported a 16% growth in first-quarter revenue to NT$592.6 billion ($18.5 billion) versus the $18.4 billion analyst consensus estimate.

The figure was closer to the higher end of TSMC’s previous expectation of $18 billion—$18.8 billion.

The key Nvidia Corp (NASDAQ:NVDA) and Apple Inc (NASDAQ:AAPL) suppliers’ quarterly revenue grew faster over a year due to big tech companies’ surging demand for artificial intelligence applications.

The outperformance fueled expectations that the key contract chipmaker will return to solid growth in 2024, battling the pandemic-induced smartphone and computer sales slump, Bloomberg reports.

The first half of the year is usually slower for Taiwanese tech firms due to corrections following the end-of-year holiday rush in major Western markets. Still, according to Reuters report, the AI trend served as a significant demand tailwind even during the lull season.

TSMC expects capital expenditures of $28 billion—$32 billion and revenue growth of at least 20% in 2024, compared to 2023’s slight decline.

TSMC said in January that its AI revenue is growing at 50% annually. The company remained engaged in expanding its geographical footprint in the US, Japan, and Germany to tap Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corp’s (NASDAQ:MSFT) growing investment in data centers.

Asian rival Samsung Electronics Co’s profit rebounded sharply in the first quarter.

Earlier this week, TSMC raised its total investment in the US to over 60% to $65 billion, backed by a $6.6 billion federal grant and $5 billion in loans to enable the production of the most advanced 2-nanometer chips. It also set Japan’s 60% local procurement goal, implying significant global expansion efforts.

TSMC stock has gained over 63% in value in the last 12 months. Investors can gain exposure to the stock via the VanEck Semiconductor ETF (NASDAQ:SMH) and the iShares Semiconductor ETF (NASDAQ:SOXX).

Price Action: TSM shares traded higher by 1.02% at $146.89 premarket on the last check Wednesday.

Also Read: Microsoft Announces Major AI Expansion and Cybersecurity Boost In Japan

Photo by Jack Hong via Shutterstock