Nvidia’s AI Muscle Propels Stock Past Apple To No. 2 Spot On SPY Holdings: What Investors Need To Know

Nvidia, Inc.‘s (NASDAQ:NVDA) lead in artificial intelligence has translated to strong fundamentals, giving a major boost to its stock price. While still trailing Apple, Inc. (NASDAQ:AAPL) in market cap, Nvidia emerged on Tuesday as the second-largest holding in the SPDR S&P 500 ETF Trust (NYSE:SPY), a key exchange-traded fund mirroring the S&P 500.

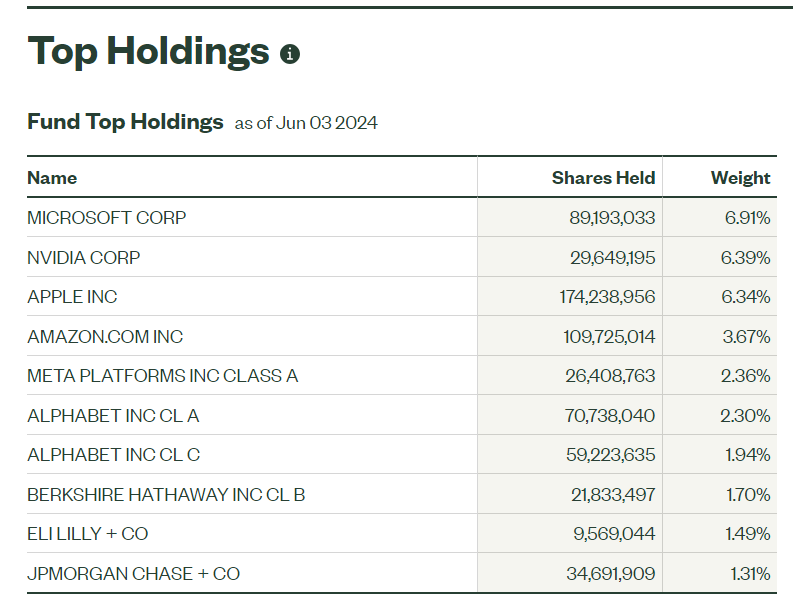

What Happened: Information from SPY’s trustee, State Street Global Advisors (SSGA), shows Nvidia now holds a 6.39% weighting, second only to Microsoft Corp. (NASDAQ:MSFT) at 6.91%. Apple falls to third with 6.34%.

Source: SSGA

Alphabet, Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), Amazon, Inc. (NASDAQ:AMZN), and Meta Platforms, Inc. (NASDAQ:META) follow closely with combined weightings of 4.24%, 3.67%, and 2.36%, respectively.

This dominance of mega-cap tech in SPY shouldn’t surprise anyone. The fund tracks the market-cap-weighted S&P 500, where a company’s value directly impacts its weight.

See Also: How to Buy Nvidia (NVDA) Stock

Why This Matters: SPY is a popular investment tool for portfolio diversification, offering exposure to the broader market without individual stock risk. Launched in 1993, it’s a go-to choice for mimicking S&P 500 returns. Tech stocks hold the biggest weighting at 31%, followed by financials (13%) and healthcare (12%).

Nvidia vs. Apple: A Tight Race: Globally, Nvidia remains the third most valuable company behind Microsoft and Apple. As of Tuesday’s close, Nvidia’s $2.864 trillion market cap trails Apple’s $2.98 trillion by just $116 billion. Premarket trading saw Nvidia rise 1.44% compared to Apple’s modest 0.17%.

If Nvidia surpasses $1,200, it could potentially dethrone Apple, according to Deepwater Asset Management‘s Gene Munster. However, Munster believes Apple stock could outperform Nvidia next year due to its anticipated AI push.

In premarket trading on Wednesday, SPY rose 0.16% to $529.25, according to Benzinga Pro data.

Photo via Shutterstock