Good Morning Traders! In today’s Market Clubhouse Morning Memo, we will discuss SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, and TSLA.

Our proprietary formula, exclusive to Market Clubhouse, dictates these price levels. This dynamic equation takes into account price, volume, and options flow. These levels are updated every day and shared with all Clubhouse Members, prior to the opening of the market.

We recommend closely monitoring these stocks, and be prepared to leverage potential breakouts or reversals. As always, stay alert and ready to adjust your tactics based on the market’s pulse to optimize your trading gains. Now, let’s dive into the stock analysis:

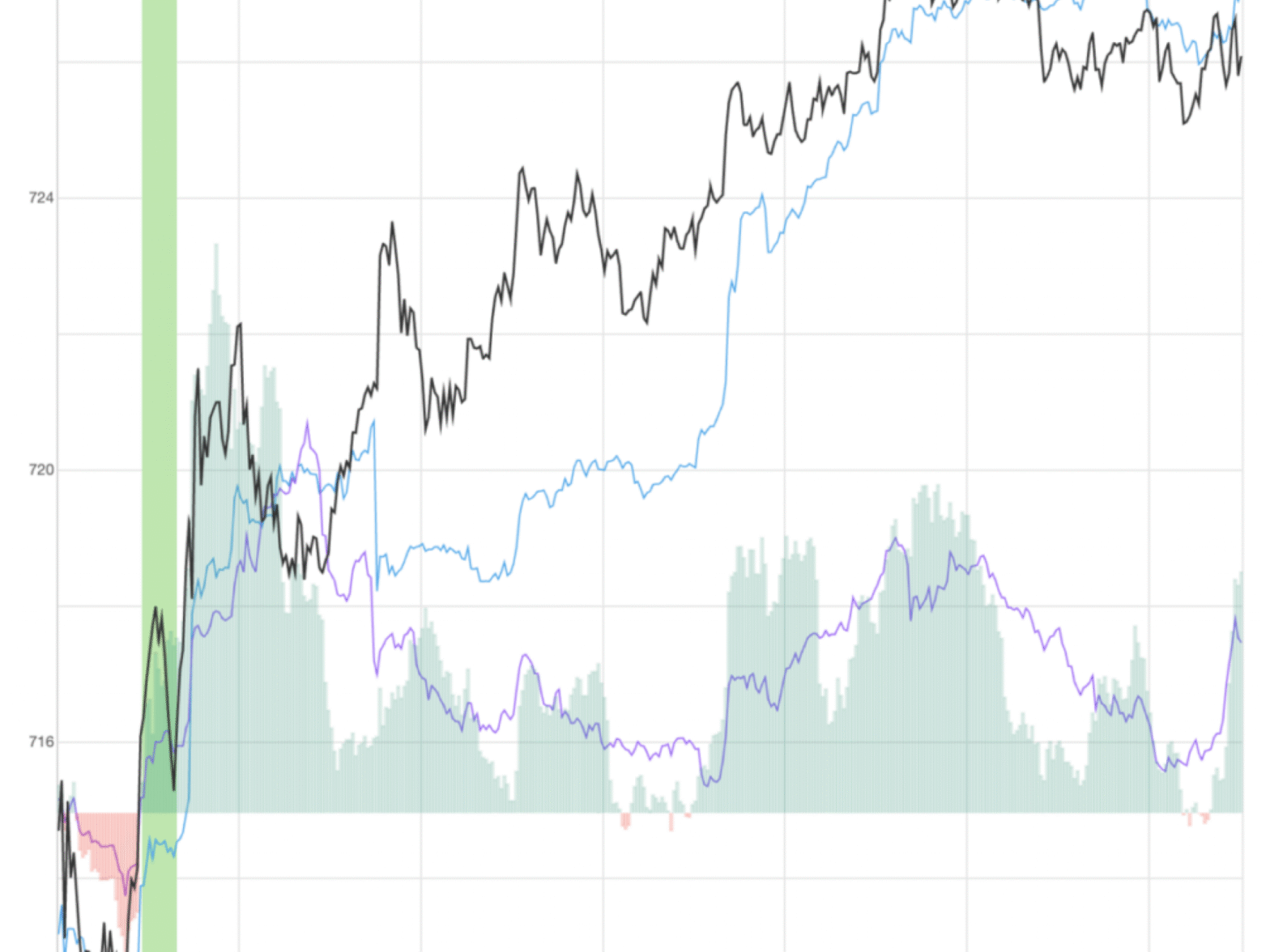

SPDR S&P 500 ETF Trust (SPY)

Bulls want SPY to maintain stability above our key pivot at 496.93, then drive higher to challenge resistance at 497.55. If buyers maintain control and firmly establish price above this level, further upside towards the next target at 498.17 becomes likely. Sustained strength there would clear the path to test the resistance at 498.93, with our ultimate bullish goal for today sitting at 500.17.

On the downside, losing the 496.93 pivot would empower sellers to push price lower towards initial support at 494.93. Continued bearish dominance could expose a deeper move to test support at 493.24. Heavy selling through this level may trigger additional weakness, targeting the strong support at 491.70, with potential capitulation down to our extreme bearish target at 490.11.

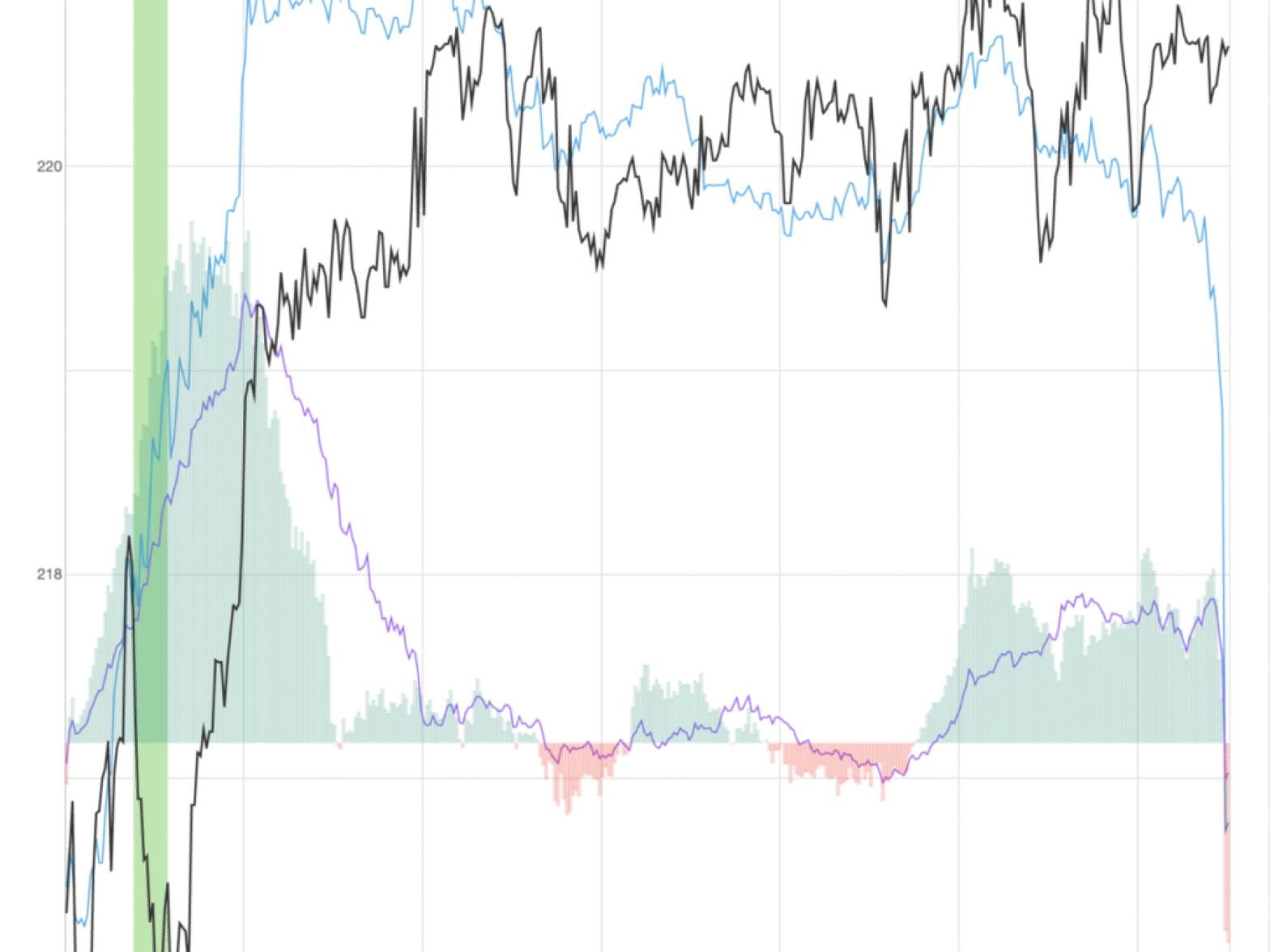

Invesco QQQ Trust Series 1 (QQQ)

QQQ bulls aim to hold firmly above our critical reference of 413.72. Strength above this point should motivate buying momentum toward the next important resistance at 414.83. If price action remains constructive and buyers sustain pressure, expect a rally toward 416.23, and potentially extend further upward to 417.49. Our highest bullish expectation for today stands at 419.19.

Conversely, if buyers fail to maintain 413.72 as support, bearish forces are likely to drive the price down initially towards 412.59. Continued weakness could escalate selling pressure, bringing support at 411.80 into play. Persistent selling beyond this point would lead to further downside tests at 410.34, with today’s ultimate bearish objective being 409.44.

Apple Inc. (AAPL)

For Apple bulls, holding the line firmly at 181.25 is essential. Successfully defending this area could ignite upward momentum towards the next bullish hurdle at 182.96. If buyers stay committed, continued advancement should reach resistance at 184.09. A strong bullish presence today might propel Apple’s price to our optimistic target of 184.96.

Should 181.25 fail under selling pressure, bears would aim to drive prices down initially toward 180.10. Persistent weakness may then lead to a deeper sell-off targeting 178.61. If selling accelerates, Apple could see additional declines toward support at 178.18, with our lowest bearish target today situated at 177.20.

Microsoft Corp. ( MSFT)

Bulls in Microsoft are looking to defend our crucial pivot at 354.73 today. A strong hold above this level could trigger bullish moves towards the next resistance level at 358.28. If buyers establish control firmly there, we anticipate continued upward movement toward 359.64. Sustained bullish enthusiasm may eventually propel Microsoft to our ultimate daily bullish target of 363.81.

If Microsoft struggles and falls decisively below 354.73, bears are likely to take charge and press lower toward the immediate support at 352.26. Breaking down this level would heighten bearish sentiment, potentially driving the price toward deeper supports at 347.85 and then 342.88. Continued bearish activity could even challenge today’s low bear target at 335.57.

NVIDIA Corporation (NVDA)

NVIDIA bulls need to gain decisive control above our significant pivot at 90.43 and push upward to initially reclaim resistance at 92.47 as new support. Continued bullish commitment could then lead the auction higher to 95.02. Sustained buying enthusiasm might fuel a further rally toward resistance at 96.58, with today’s bullish ambition reaching as high as 98.02.

If bulls fail to defend 90.43 today, bearish forces may quickly seize control, targeting immediate downside support at 89.28. Increased selling could further test the next level at 87.80. Weakening conditions may drive price action lower towards 86.32, with potential bearish exhaustion leading NVIDIA down to our lowest bearish objective at 84.52.

Alphabet Inc Class A (GOOGL)

Alphabet bulls seek firm control above today’s pivotal level of 141.71, aiming initially for an advance toward resistance at 143.17. If bullish momentum remains steady, expect further price appreciation towards our maximum bullish target at 144.72.

On the bearish side, failure to hold 141.71 would likely see bears aggressively target initial downside support at 140.57. Further selling pressure could push Alphabet to challenge deeper support at 139.46. Under intensifying bearish activity, the price may retreat as low as today’s ultimate bearish target of 137.79.

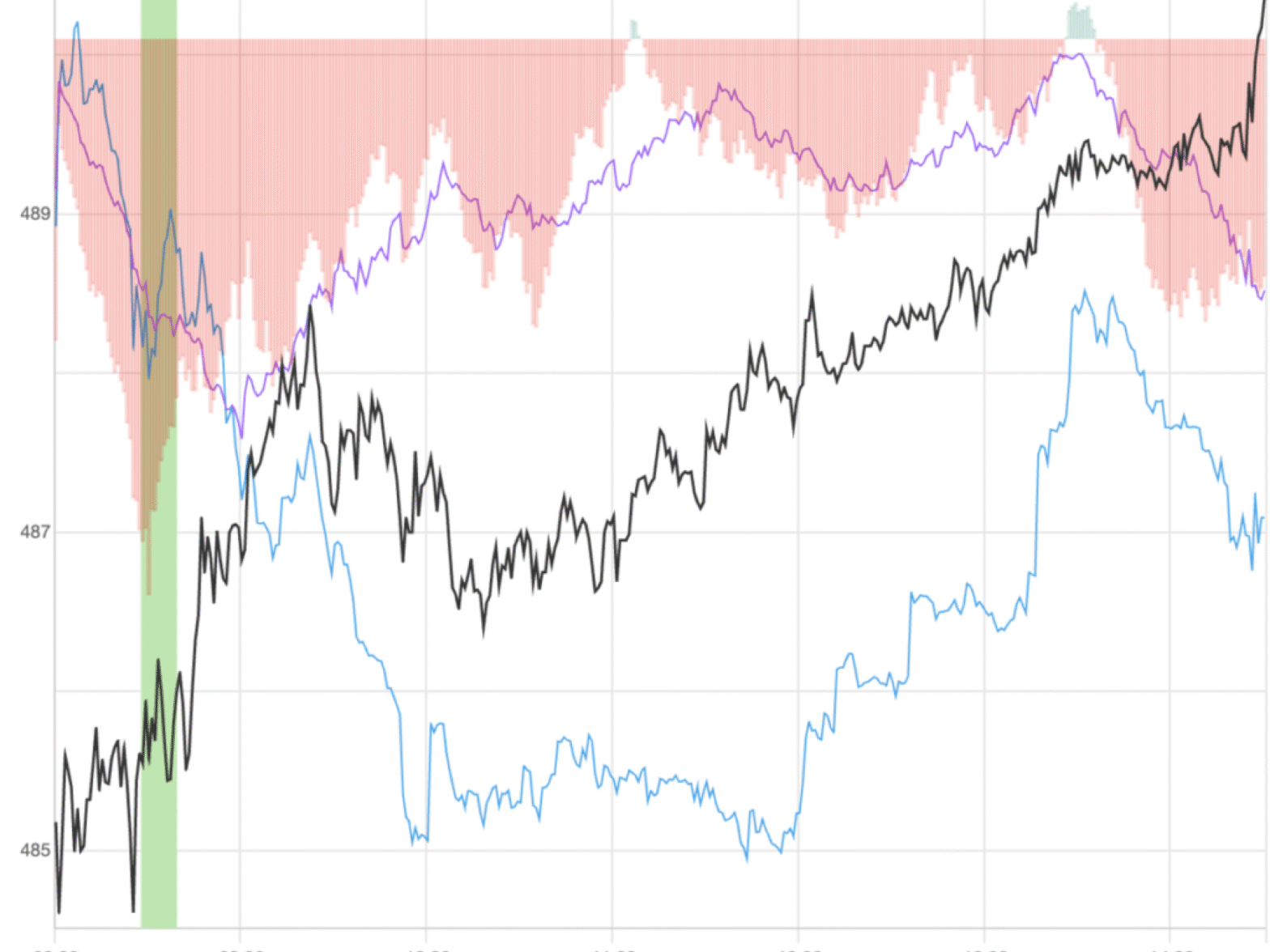

Meta Platforms Inc (NASDAQ:META)

Bulls in Meta aim to keep the price strongly above our pivotal level at 488.81. Sustaining this bullish momentum would open the door to an upward test of resistance at 492.33. Ongoing buyer participation may enable further upward movement towards 498.03, ultimately targeting today’s ambitious bullish objective at 500.83.

If Meta cannot hold above 488.81, bearish activity could intensify, quickly driving price action lower toward support at 483.11. Continued selling pressure could push further downward, testing the next level at 479.47. Accelerated bearish momentum would likely trigger deeper selling toward today’s lowest bearish target of 475.19.

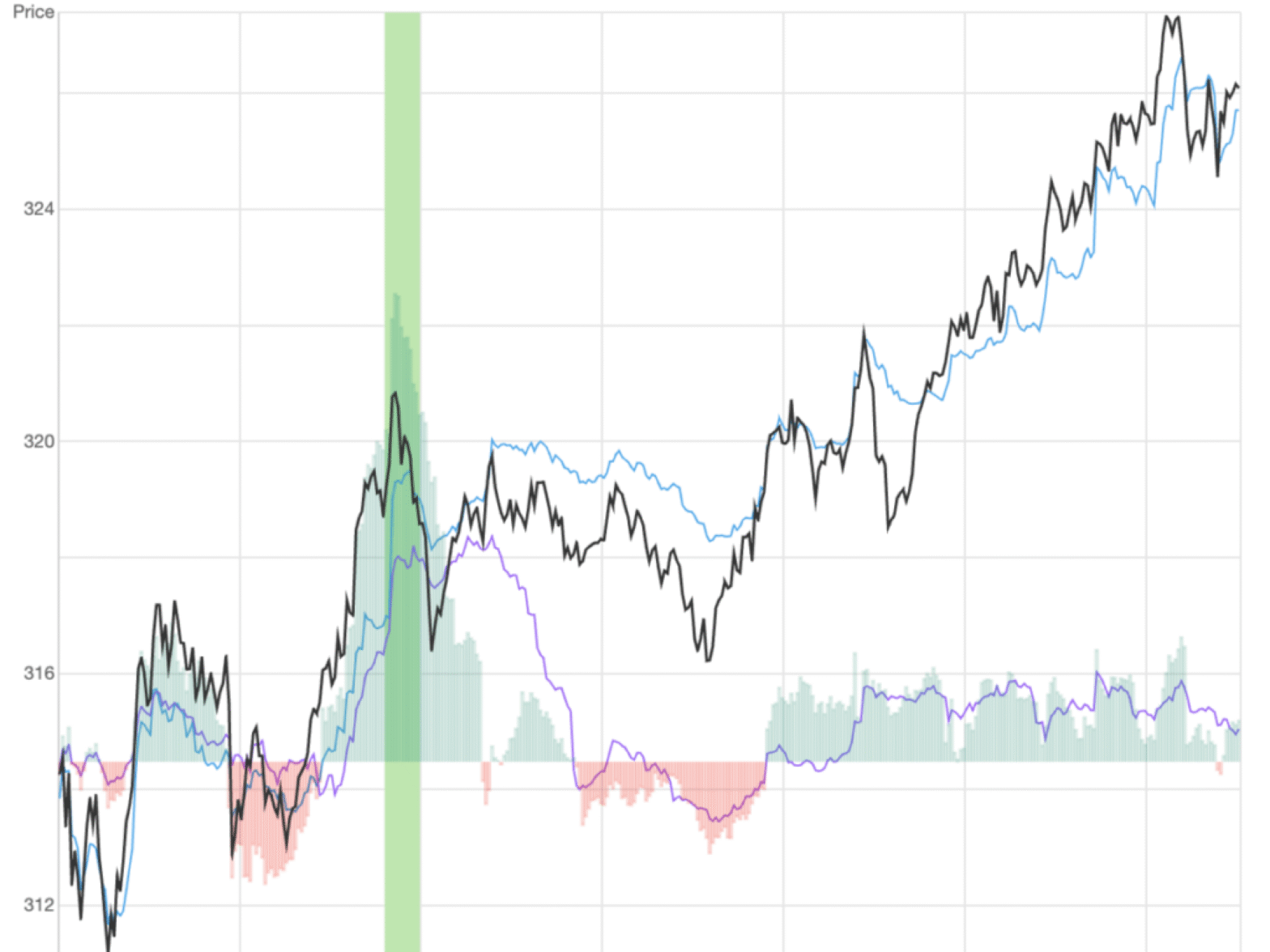

Tesla Inc. (NASDAQ:TSLA)

Tesla bulls are initially aiming to secure the price action firmly above today’s pivot at 223.98, with their first bullish challenge lying at 226.53. If bullish momentum stays strong, expect buyers to target a higher push toward the significant level at 230.65. Continued strength from the broader market may push Tesla even higher to 235.74, with today’s maximum bullish target set at 238.50.

On the downside, if bulls lose control at 223.98, bears will aim aggressively lower toward support at 220.65. Further weakness could bring selling into deeper support at 217.78. Should bearish pressure increase, we anticipate a potential retreat toward Tesla’s lowest bearish objective for today at 213.88.

Final Word:

Markets today lack impactful economic reports but face intense volatility driven by escalating tensions surrounding global trade conflicts and newly implemented tariffs. Traders must remain highly vigilant, as price action will hinge on unpredictable trade-related headlines that could significantly impact market sentiment throughout the session.

Given the elevated uncertainty, managing risk carefully is crucial today. Expect large and potentially rapid price movements across sectors. Keep position sizing prudent, remain disciplined, and stay nimble to effectively navigate today’s turbulent conditions. Good luck and trade carefully!

The Morning Memo is curated by RIPS, a pro trader with years of experience in equities, options, and futures trading. RIPS is at the heart of the exclusive Market Clubhouse community, offering his insights, expertise, and real-time mentorship.

Start your day with a live daily market analysis, a carefully selected watch list, early access to the Morning Memo, and exclusive Market Clubhouse price levels, providing precise support and resistance indicators. When you become a member of Market Clubhouse, you will gain early access to the Morning Memo, just like this one, every single day—hours before it’s published. You will also have access to a live stream with zero latency and screen sharing, enabling you to witness Rips executing his trades in real-time and sharing his exclusive trading plans, strategies, and live decision-making.

For a limited time during our special promotion, you can join RIPS and get a full access pass to Market Clubhouse for 7 full days for just $7. Check it out at https://marketclubhouse.club/7Days/ where you can trade live with him and tap into his wealth of knowledge and experience. You can also catch Rips on his live day trading streams every Monday-Friday at 8 am EST on the Market Clubhouse YouTube channel: https://www.youtube.com/@MarketClubhouse.