Whales with a lot of money to spend have taken a noticeably bullish stance on Roblox.

Looking at options history for Roblox (NYSE:RBLX) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $53,960 and 6, calls, for a total amount of $358,007.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $76.0 to $90.0 for Roblox over the last 3 months.

Insights into Volume & Open Interest

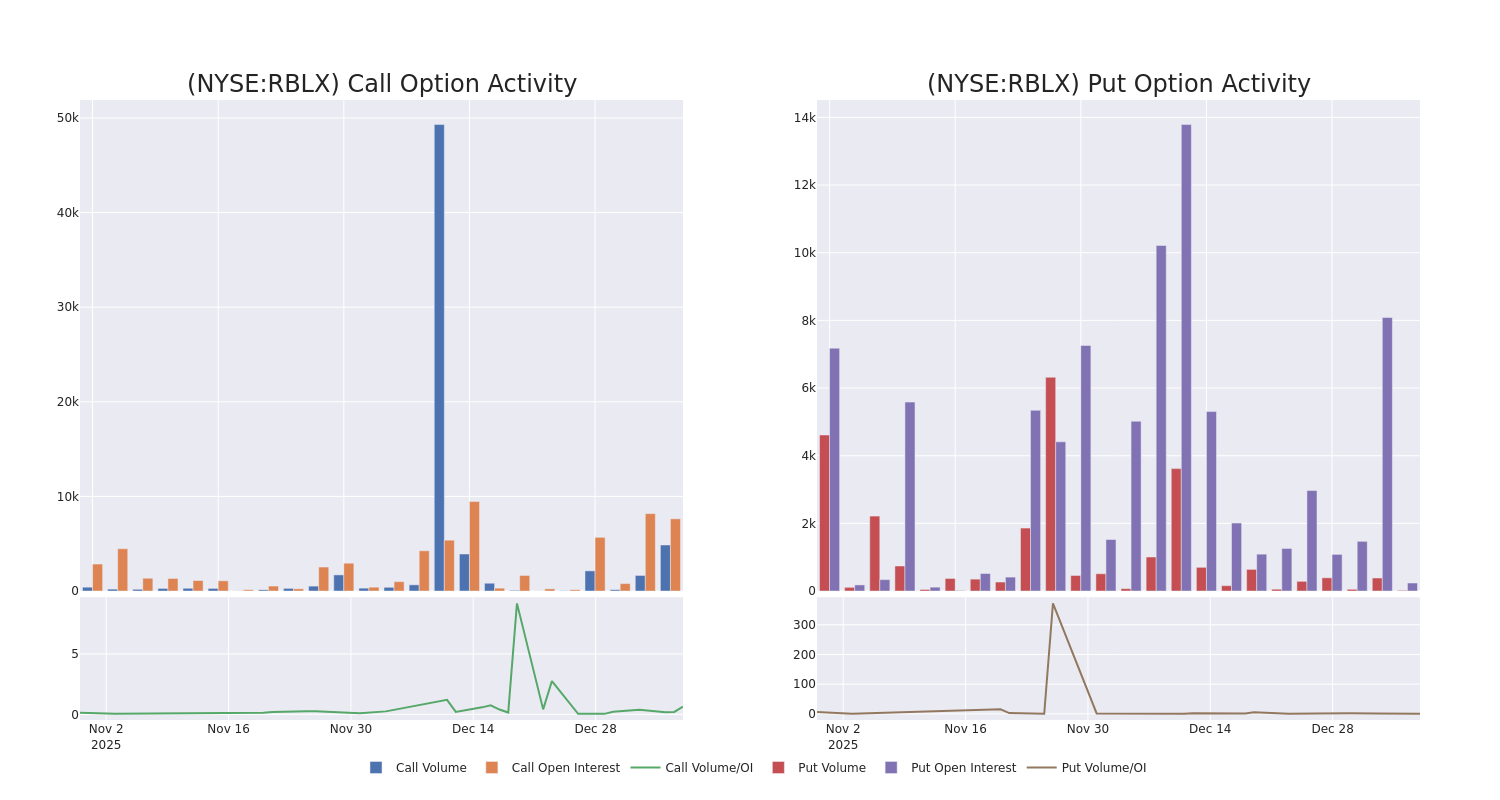

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Roblox’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roblox’s whale trades within a strike price range from $76.0 to $90.0 in the last 30 days.

Roblox 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | CALL | SWEEP | BULLISH | 02/20/26 | $2.95 | $2.9 | $2.9 | $90.00 | $99.3K | 7.2K | 365 |

| RBLX | CALL | TRADE | BEARISH | 02/20/26 | $3.15 | $3.1 | $3.1 | $90.00 | $85.8K | 7.2K | 2.1K |

| RBLX | CALL | SWEEP | BULLISH | 02/20/26 | $2.95 | $2.91 | $2.95 | $90.00 | $65.1K | 7.2K | 1.2K |

| RBLX | CALL | TRADE | BEARISH | 02/20/26 | $2.99 | $2.95 | $2.95 | $90.00 | $43.3K | 7.2K | 719 |

| RBLX | CALL | TRADE | BULLISH | 01/09/26 | $1.58 | $1.5 | $1.55 | $76.00 | $38.7K | 212 | 270 |

About Roblox

Roblox operates a free-to-play online video game platform with about 150 million daily active users. This platform has spawned a virtual universe and a Roblox economy based on the Robux currency. The platform houses millions of games from a wide range of creators—spanning from young gamers themselves to professional development studios. Roblox offers creators the tools, publishing abilities, and platform for their games, enabling anyone to create a game. Creators earn money when gamers make optional in-game purchases within their games and by offering space for real-world advertising, and Roblox earns revenue primarily by taking a cut of these earnings.

Having examined the options trading patterns of Roblox, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Roblox

- Currently trading with a volume of 1,173,172, the RBLX’s price is up by 0.43%, now at $76.16.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 29 days.

What Analysts Are Saying About Roblox

In the last month, 4 experts released ratings on this stock with an average target price of $106.0.

- An analyst from B. Riley Securities has revised its rating downward to Buy, adjusting the price target to $125.

- Reflecting concerns, an analyst from Freedom Capital Markets lowers its rating to Hold with a new price target of $99.

- Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $100.

- An analyst from Jefferies has decided to maintain their Hold rating on Roblox, which currently sits at a price target of $100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics.