Financial giants have made a conspicuous bearish move on Pfizer. Our analysis of options history for Pfizer (NYSE:PFE) revealed 11 unusual trades.

Delving into the details, we found 9% of traders were bullish, while 90% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $282,025, and 9 were calls, valued at $505,680.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $40.0 for Pfizer over the last 3 months.

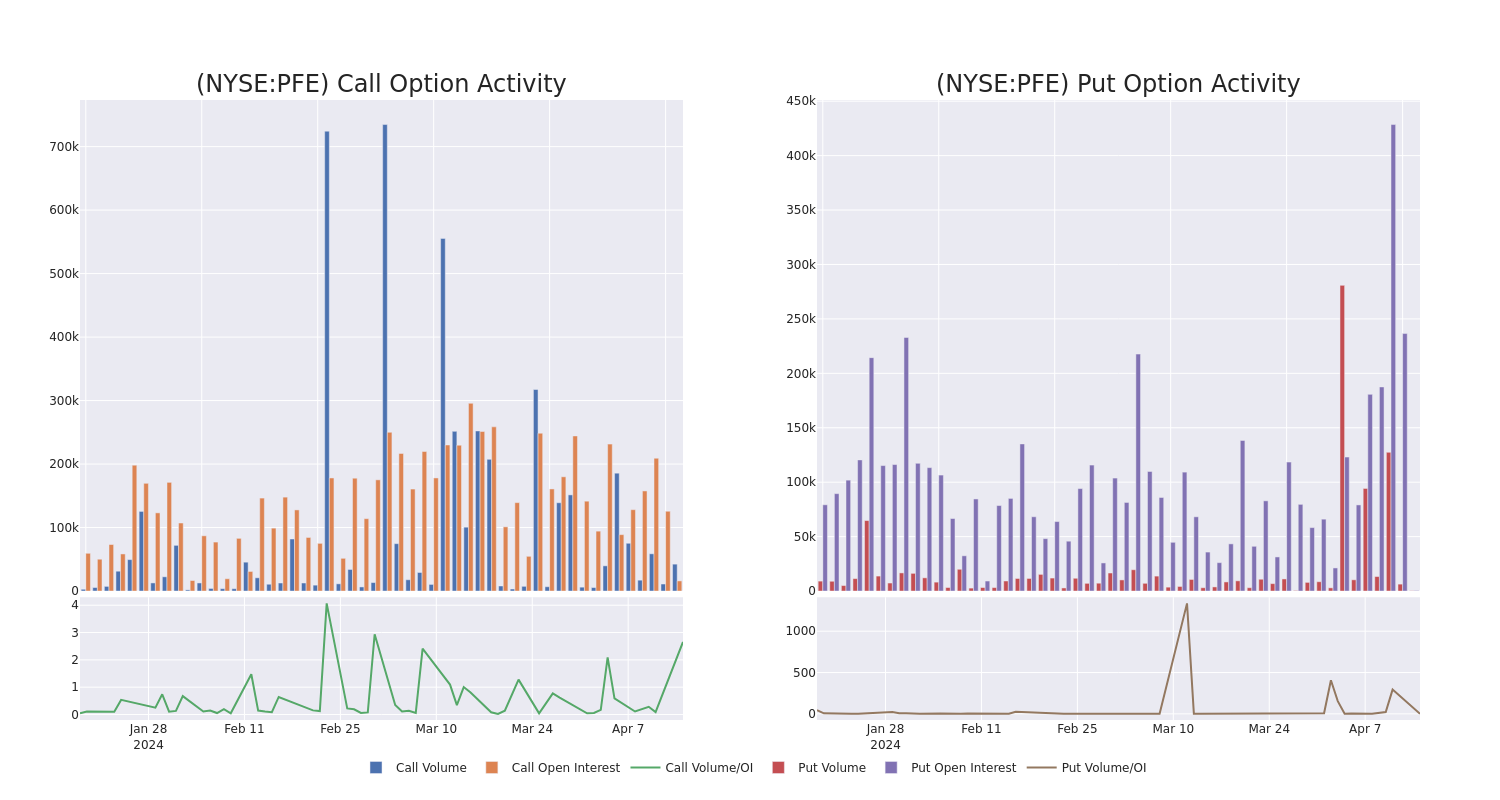

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pfizer’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pfizer’s substantial trades, within a strike price spectrum from $22.5 to $40.0 over the preceding 30 days.

Pfizer 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | CALL | TRADE | NEUTRAL | 04/26/24 | $0.26 | $0.24 | $0.25 | $26.50 | $154.7K | 1.0K | 14.0K |

| PFE | PUT | SWEEP | BEARISH | 10/18/24 | $5.7 | $5.6 | $5.7 | $31.00 | $141.9K | 470 | 249 |

| PFE | PUT | SWEEP | BEARISH | 10/18/24 | $5.65 | $5.55 | $5.65 | $31.00 | $140.0K | 470 | 249 |

| PFE | CALL | SWEEP | BEARISH | 04/26/24 | $0.28 | $0.27 | $0.28 | $26.50 | $91.2K | 1.0K | 6.1K |

| PFE | CALL | SWEEP | BULLISH | 04/26/24 | $0.29 | $0.28 | $0.29 | $26.50 | $57.5K | 1.0K | 220 |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Following our analysis of the options activities associated with Pfizer, we pivot to a closer look at the company’s own performance.

Pfizer’s Current Market Status

- With a volume of 2,542,573, the price of PFE is down -0.02% at $25.85.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 16 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.