Whales with a lot of money to spend have taken a noticeably bullish stance on Micron Technology.

Looking at options history for Micron Technology (NASDAQ:MU) we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $223,027 and 11, calls, for a total amount of $480,135.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $135.0 for Micron Technology during the past quarter.

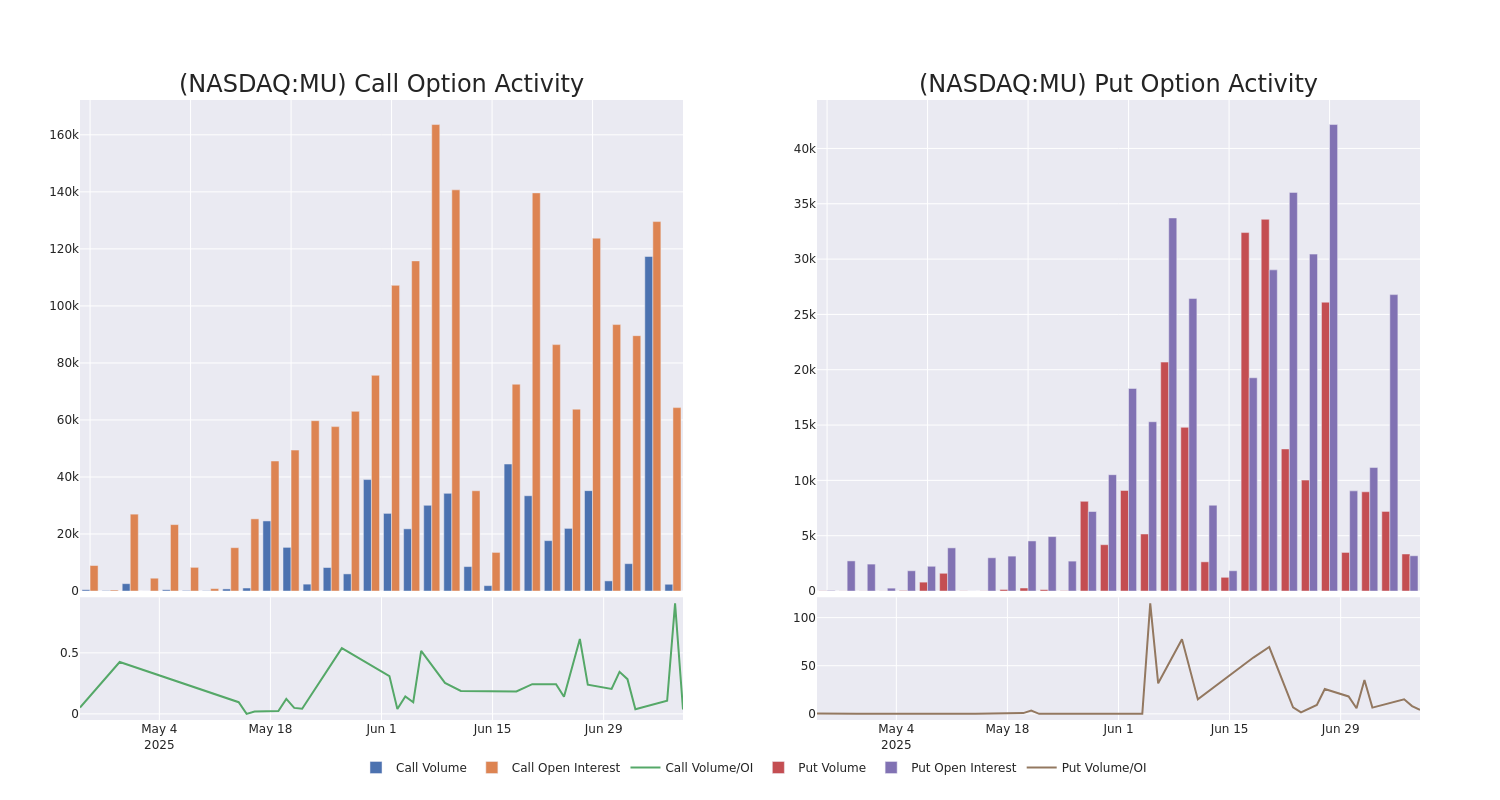

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Micron Technology’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Micron Technology’s substantial trades, within a strike price spectrum from $110.0 to $135.0 over the preceding 30 days.

Micron Technology Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | TRADE | NEUTRAL | 09/19/25 | $5.35 | $5.25 | $5.3 | $135.00 | $123.4K | 23.8K | 665 |

| MU | CALL | TRADE | BEARISH | 07/11/25 | $3.6 | $3.45 | $3.5 | $122.00 | $70.0K | 2.2K | 16 |

| MU | PUT | TRADE | BEARISH | 12/17/27 | $32.7 | $30.45 | $32.47 | $130.00 | $64.9K | 223 | 20 |

| MU | PUT | SWEEP | BEARISH | 07/11/25 | $0.56 | $0.54 | $0.56 | $121.00 | $56.5K | 593 | 1.6K |

| MU | CALL | SWEEP | BULLISH | 08/08/25 | $2.43 | $2.3 | $2.3 | $135.00 | $49.4K | 508 | 0 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Having examined the options trading patterns of Micron Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Micron Technology

- Trading volume stands at 2,807,193, with MU’s price up by 0.49%, positioned at $125.03.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 77 days.

Professional Analyst Ratings for Micron Technology

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $152.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Micron Technology, maintaining a target price of $135.

* An analyst from B of A Securities persists with their Neutral rating on Micron Technology, maintaining a target price of $140.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $165.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Micron Technology, targeting a price of $172.

* An analyst from Wedbush has decided to maintain their Outperform rating on Micron Technology, which currently sits at a price target of $150.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Micron Technology options trades with real-time alerts from Benzinga Pro.