Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets (NASDAQ:HOOD) revealed 23 unusual trades.

Delving into the details, we found 43% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $417,123, and 17 were calls, valued at $933,722.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $175.0 for Robinhood Markets during the past quarter.

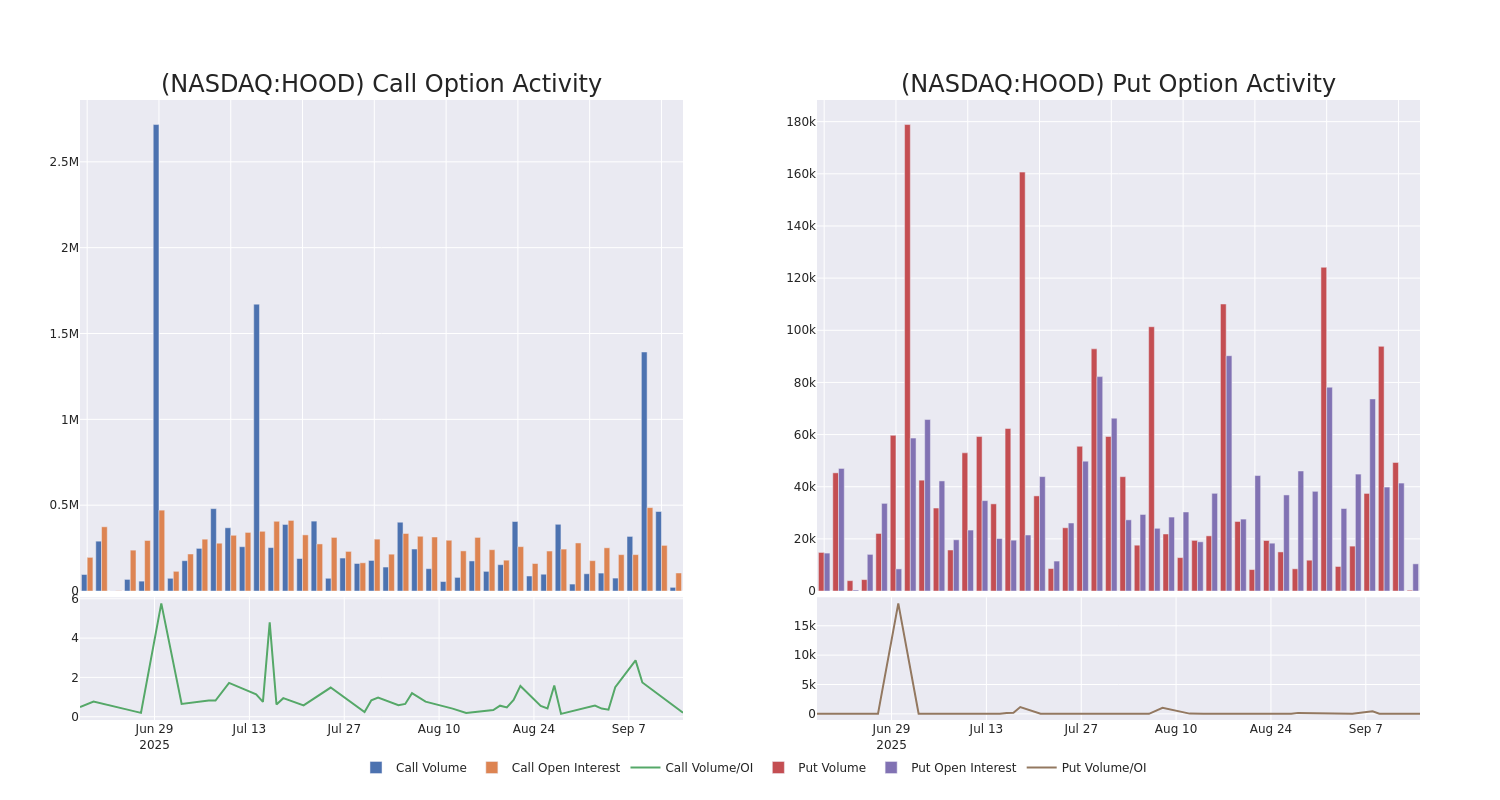

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Robinhood Markets’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Robinhood Markets’s significant trades, within a strike price range of $20.0 to $175.0, over the past month.

Robinhood Markets Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | BULLISH | 11/21/25 | $20.65 | $20.6 | $20.65 | $100.00 | $206.5K | 5.6K | 159 |

| HOOD | PUT | TRADE | BEARISH | 09/18/26 | $28.65 | $28.5 | $28.65 | $120.00 | $143.2K | 137 | 52 |

| HOOD | CALL | SWEEP | BEARISH | 09/19/25 | $2.72 | $2.47 | $2.51 | $117.00 | $126.0K | 3.7K | 575 |

| HOOD | PUT | TRADE | BEARISH | 09/18/26 | $68.15 | $68.0 | $68.15 | $175.00 | $102.2K | 10 | 15 |

| HOOD | PUT | TRADE | NEUTRAL | 09/18/26 | $25.9 | $25.6 | $25.75 | $115.00 | $82.4K | 218 | 42 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fraud detection, derivatives, fractional shares, recurring investments, and others.

Following our analysis of the options activities associated with Robinhood Markets, we pivot to a closer look at the company’s own performance.

Robinhood Markets’s Current Market Status

- Trading volume stands at 11,291,702, with HOOD’s price down by -0.52%, positioned at $114.43.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 44 days.

Professional Analyst Ratings for Robinhood Markets

2 market experts have recently issued ratings for this stock, with a consensus target price of $132.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Mizuho has decided to maintain their Outperform rating on Robinhood Markets, which currently sits at a price target of $145.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Robinhood Markets, targeting a price of $120.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.