Financial giants have made a conspicuous bullish move on Chewy. Our analysis of options history for Chewy (NYSE:CHWY) revealed 10 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $320,850, and 3 were calls, valued at $211,840.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $12.5 and $22.5 for Chewy, spanning the last three months.

Volume & Open Interest Development

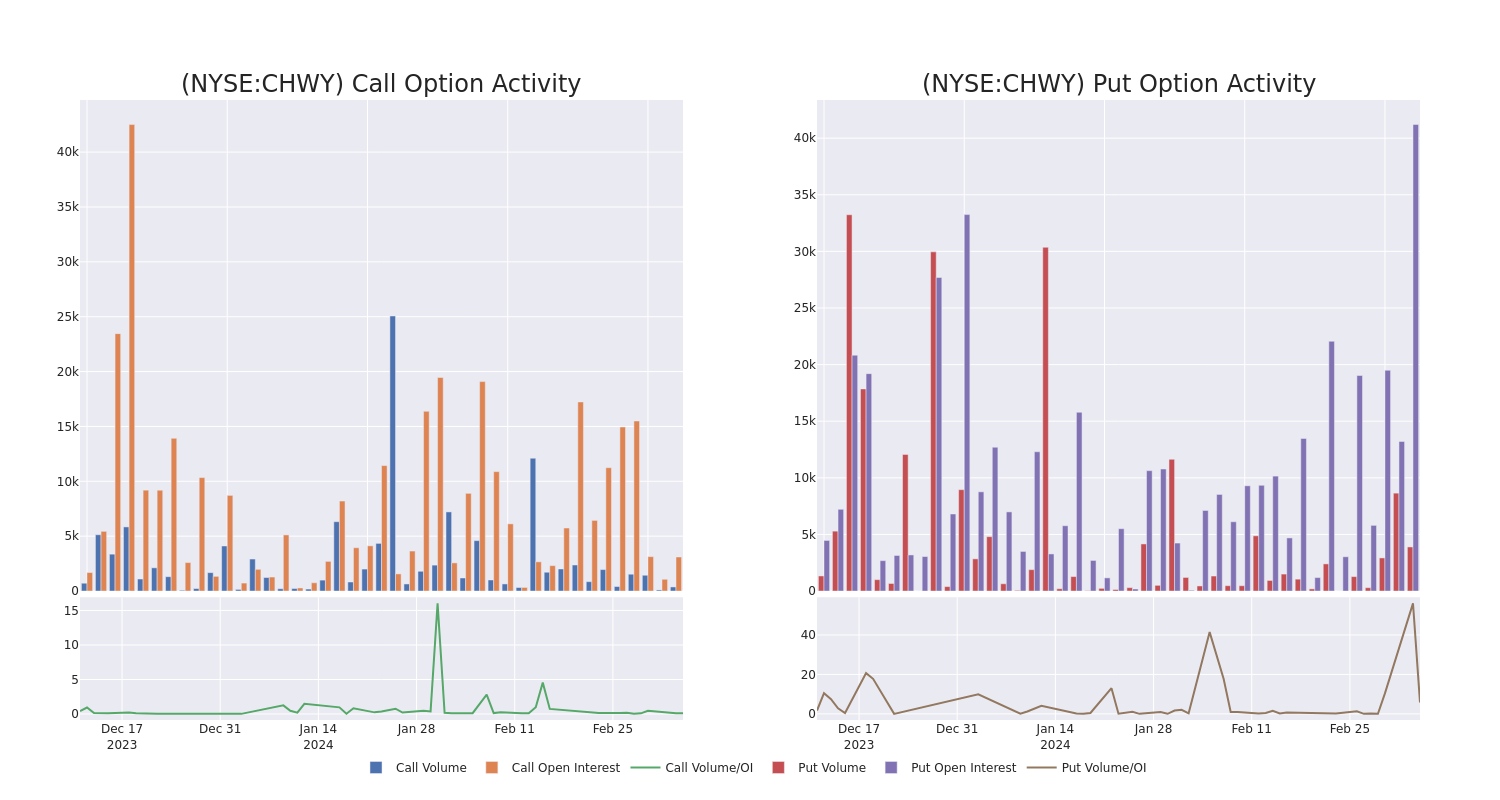

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Chewy’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chewy’s whale activity within a strike price range from $12.5 to $22.5 in the last 30 days.

Chewy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CHWY | CALL | SWEEP | BULLISH | 01/17/25 | $17.50 | $142.0K | 1.9K | 0 |

| CHWY | PUT | SWEEP | BULLISH | 09/20/24 | $12.50 | $69.4K | 6.9K | 1.6K |

| CHWY | PUT | SWEEP | BULLISH | 09/20/24 | $12.50 | $60.9K | 6.9K | 1.2K |

| CHWY | PUT | SWEEP | BEARISH | 07/19/24 | $22.50 | $56.8K | 2.9K | 121 |

| CHWY | CALL | SWEEP | BULLISH | 07/19/24 | $15.00 | $39.9K | 1.2K | 89 |

About Chewy

Chewy is the largest e-commerce pet care retailer in the U.S., generating $10.1 billion in 2022 sales across pet food, treats, hard goods, and pharmacy categories. The firm was founded in 2011, acquired by PetSmart in 2017, and tapped public markets as a standalone company in 2019 after spending a couple of years developing under the aegis of the pet superstore chain. The firm generates sales from pet food, treats, over-the-counter medications, medical prescription fulfillment, and hard goods, like crates, leashes, and bowls.

In light of the recent options history for Chewy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Chewy’s Current Market Status

- Currently trading with a volume of 2,009,164, the CHWY’s price is up by 1.32%, now at $17.6.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 14 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Chewy with Benzinga Pro for real-time alerts.