Financial giants have made a conspicuous bearish move on Hewlett Packard. Our analysis of options history for Hewlett Packard (NYSE:HPE) revealed 51 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 52% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $209,460, and 47 were calls, valued at $4,477,387.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $14.0 to $22.0 for Hewlett Packard over the recent three months.

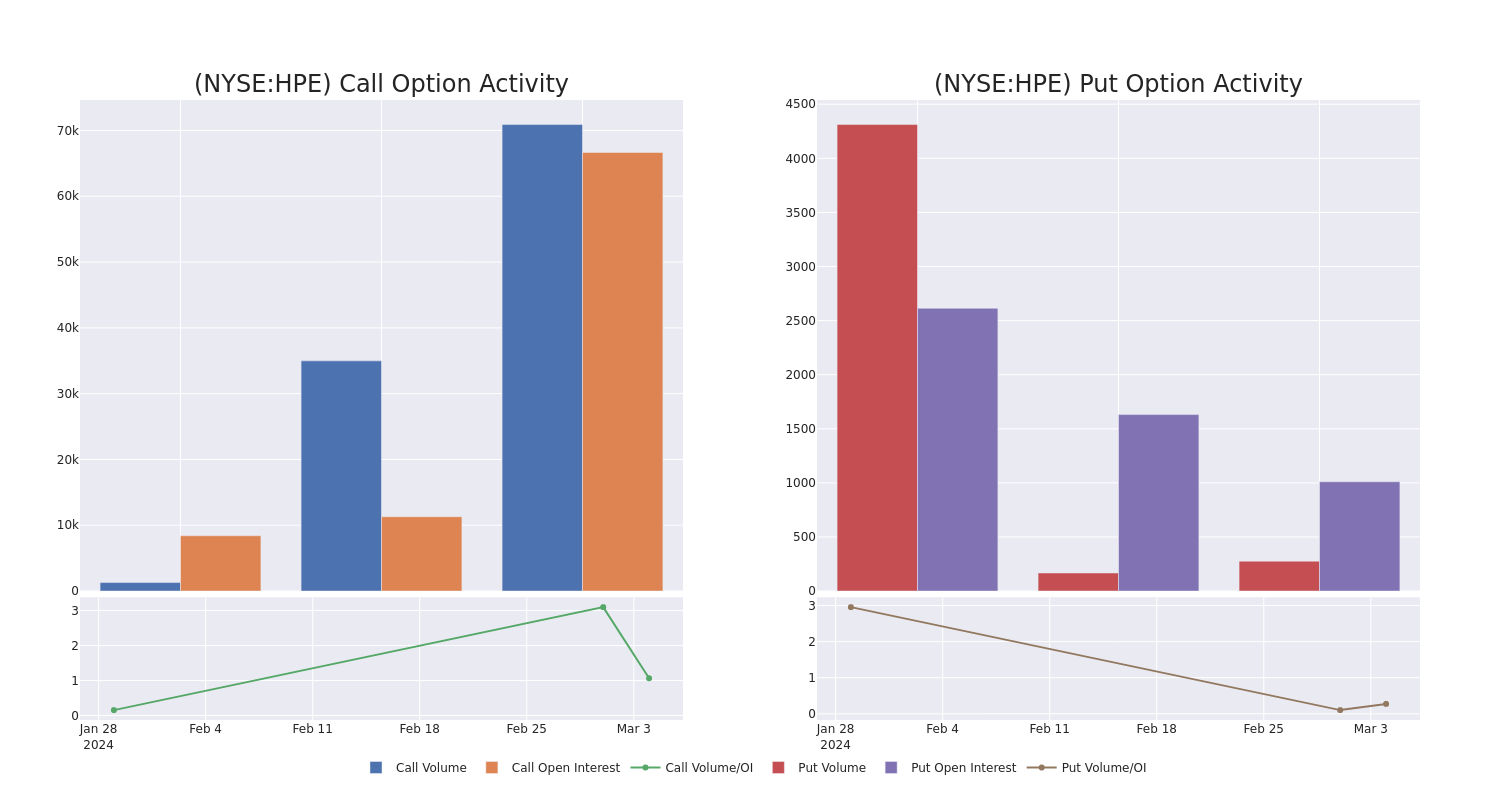

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Hewlett Packard stands at 4403.09, with a total volume reaching 126,493.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Hewlett Packard, situated within the strike price corridor from $14.0 to $22.0, throughout the last 30 days.

Hewlett Packard Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| HPE | CALL | SWEEP | BEARISH | 08/16/24 | $19.00 | $497.6K | 4.9K | 8.7K |

| HPE | CALL | SWEEP | BEARISH | 08/16/24 | $19.00 | $306.1K | 4.9K | 2.0K |

| HPE | CALL | TRADE | BEARISH | 01/16/26 | $15.00 | $248.0K | 910 | 930 |

| HPE | CALL | SWEEP | BULLISH | 03/15/24 | $19.00 | $215.6K | 15.4K | 7.9K |

| HPE | CALL | SWEEP | BULLISH | 03/15/24 | $19.00 | $196.0K | 15.4K | 3.9K |

About Hewlett Packard

Hewlett Packard Enterprise is an information technology vendor that provides hardware and software to enterprises. Its primary product lines are compute servers, storage arrays, and networking equipment; it also has a high-performance computing business. HPE’s stated goal is to be a complete edge-to-cloud company, and its portfolio enables hybrid clouds and hyperconverged infrastructure. It uses a primarily outsourced manufacturing model and employs 60,000 people worldwide.

Current Position of Hewlett Packard

- With a trading volume of 25,719,411, the price of HPE is up by 1.27%, reaching $18.33.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for Hewlett Packard

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $16.75.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Hewlett Packard, which currently sits at a price target of $14.

- An analyst from Wells Fargo has revised its rating downward to Equal-Weight, adjusting the price target to $17.

- An analyst from Evercore ISI Group persists with their In-Line rating on Hewlett Packard, maintaining a target price of $18.

- An analyst from Stifel has decided to maintain their Buy rating on Hewlett Packard, which currently sits at a price target of $18.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hewlett Packard, Benzinga Pro gives you real-time options trades alerts.