Financial giants have made a conspicuous bearish move on Netflix. Our analysis of options history for Netflix (NASDAQ:NFLX) revealed 13 unusual trades.

Delving into the details, we found 15% of traders were bullish, while 76% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $109,130, and 10 were calls, valued at $473,290.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $760.0 to $1000.0 for Netflix during the past quarter.

Analyzing Volume & Open Interest

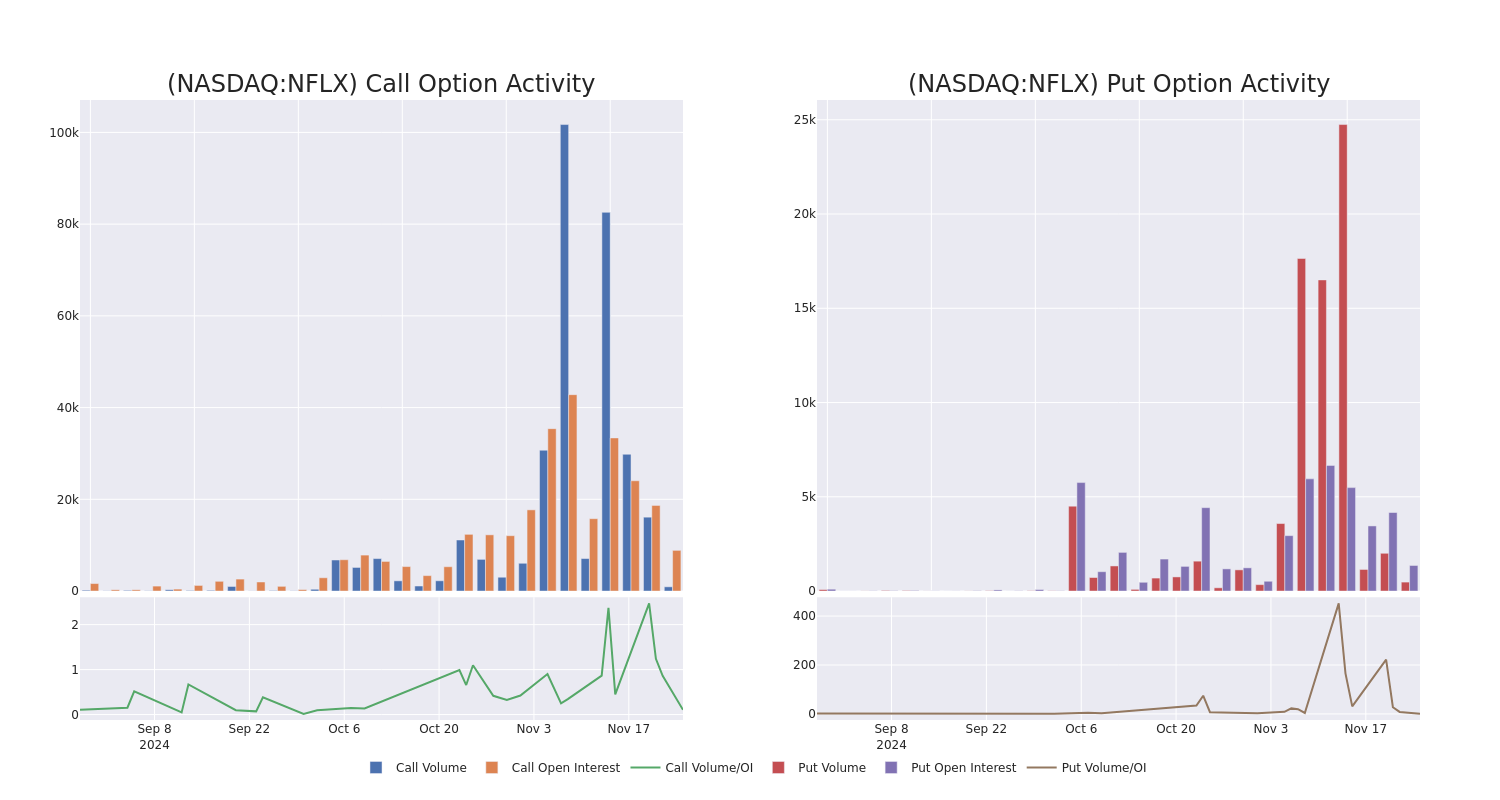

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Netflix’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Netflix’s significant trades, within a strike price range of $760.0 to $1000.0, over the past month.

Netflix 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFLX | CALL | TRADE | BEARISH | 06/20/25 | $163.15 | $157.35 | $158.87 | $805.00 | $158.8K | 20 | 10 |

| NFLX | CALL | SWEEP | BEARISH | 03/21/25 | $166.9 | $165.0 | $165.0 | $760.00 | $82.5K | 306 | 0 |

| NFLX | PUT | SWEEP | BEARISH | 11/29/24 | $13.85 | $10.95 | $13.0 | $890.00 | $41.3K | 709 | 419 |

| NFLX | PUT | SWEEP | BEARISH | 01/17/25 | $39.25 | $36.8 | $39.25 | $900.00 | $39.2K | 325 | 10 |

| NFLX | CALL | SWEEP | BULLISH | 11/29/24 | $2.39 | $2.33 | $2.37 | $915.00 | $38.6K | 1.5K | 632 |

About Netflix

Netflix’s relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 280 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Following our analysis of the options activities associated with Netflix, we pivot to a closer look at the company’s own performance.

Where Is Netflix Standing Right Now?

- With a volume of 71,159, the price of NFLX is up 0.27% at $900.2.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 57 days.

Expert Opinions on Netflix

4 market experts have recently issued ratings for this stock, with a consensus target price of $968.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $950.

* An analyst from B of A Securities persists with their Buy rating on Netflix, maintaining a target price of $1000.

* Consistent in their evaluation, an analyst from Pivotal Research keeps a Buy rating on Netflix with a target price of $1100.

* An analyst from Guggenheim has decided to maintain their Buy rating on Netflix, which currently sits at a price target of $825.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Netflix with Benzinga Pro for real-time alerts.